Form St-101 - Schedule H - Report Of Clothing And Footwear Sales Eligible For Exemption - New York State Department Of Taxation And Finance Page 6

ADVERTISEMENT

ST-101.7 (2/04) Page 6 of 6

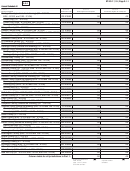

A04

Annual Schedule H

Column A

Column B

Column C

Column D

Column E

Column F

+

=

Taxing jurisdiction

Jurisdiction

Sales subject

Purchases subject

X

Tax rate

Sales and use tax

code

to tax

to tax

(C + D) x E

Tompkins County

TO H5095

.00

.00

4%

(outside the following) (3/1 - 5/31/03)

Tompkins County

(outside the following) (8/26 - 9/1/03

and 1/26 - 2/1/04)

Ithaca (city) (3/1 - 5/31/03)

IT H5086

.00

.00

4%

Ithaca (city) (8/26 - 9/1/03 and 1/26 - 2/1/04)

Ulster County (3/1 - 5/31/03)

UL H5132

.00

.00

4%

Ulster County (8/26 - 9/1/03 and 1/26 - 2/1/04)

Warren County

WA H5295

.00

.00

3%

(outside the following) (3/1 - 5/31/03)

Warren County

(outside the following) (8/26 - 9/1/03

and 1/26 - 2/1/04)

Glens Falls (city) (3/1 - 5/31/03)

GL H5215

.00

.00

3%

Glens Falls (city) (8/26 - 9/1/03 and 1/26 - 2/1/04)

Washington County (3/1 - 5/31/03)

WA H5305

.00

.00

3%

Washington County (8/26 - 9/1/03 and 1/26 - 2/1/04)

Wayne County (3/1 - 5/31/03)

WA H5405

.00

.00

3%

Wayne County (8/26 - 9/1/03 and 1/26/04 - 2/1/04)

Westchester County

(outside the following) (3/1 - 5/31/03,

WE H5595

.00

.00

2¾%

8/26 - 9/1/03, and 1/26 - 2/1/04)

Mount Vernon

(city) (3/1 - 5/31/03, 8/26 - 9/1/03, and

MO H5523

.00

.00

4¼%

1/26 - 2/1/04)

New Rochelle

(city) (3/1 - 5/31/03, 8/26 - 9/1/03, and

NE H6898

.00

.00

4¼%

1/26 - 2/1/04)

White Plains (city) (3/1 - 5/31/03, 8/26 - 9/1/03, and

1/26 - 2/1/04)

WH H5563

.00

.00

3¾%

Yonkers (city) (3/1 - 5/31/03, 8/26 - 9/1/03, and

1/26 - 2/1/04)

YO H6565

.00

.00

4¼%

Wyoming County (3/1 - 5/31/03)

WY H5606

.00

.00

4%

Wyoming County (8/26 - 9/1/03 and 1/26 - 2/1/04)

Yates County (3/1 - 5/31/03)

YA H5705

.00

.00

3%

Yates County (8/26 - 9/1/03 and 1/26 - 2/1/04)

1

2

3

Column totals for all jurisdictions in Part 2:

.00

.00

Include this

Include this

Include this

amount on

amount on

amount on

Form ST-101, page 2,

Form ST-101, page 2,

Form ST-101, page 2,

Column C, in box 3.

Column D, in box 4.

Column F, in box 5.

Need help?

Hotline for the hearing and speech impaired:

Internet access:

If you have access to a telecommunications device for the

(for information, forms, and publications)

deaf (TDD), contact us at 1 800 634-2110. If you do not

own a TDD, check with independent living centers or

community action programs to find out where machines are

Fax-on-demand forms: Forms are

available for public use.

available 24 hours a day,

7 days a week.

1 800 748-3676

Persons with disabilities: In compliance with the

Americans with Disabilities Act, we will ensure that our

lobbies, offices, meeting rooms, and other facilities are

Telephone assistance is available from 8:00

to

A.M.

accessible to persons with disabilities. If you have

5:00

(eastern time), Monday through Friday.

P.M.

questions about special accommodations for persons

with disabilities, please call 1 800 972-1233.

To order forms and publications:

1 800 462-8100

If you need to write, address your letter to:

Business Tax Information Center:

1 800 972-1233

NYS TAX DEPARTMENT

BUSINESS TAX INFORMATION CENTER

From areas outside the U.S. and

W A HARRIMAN CAMPUS

ALBANY NY 12227

outside Canada:

(518) 485-6800

Privacy notification

See Form ST-101-I, Instructions for Form ST-101, page 4.

Web site address:

Need help? call 1 800 972-1233

To order forms, call 1 800 462-8100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6