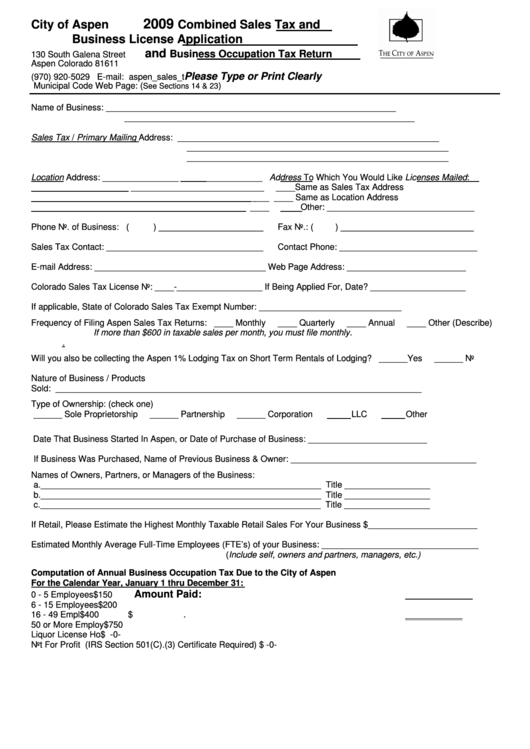

2009 Combined Sales Tax And Business License Application And Business Occupation Tax Return - City Of Aspen

ADVERTISEMENT

2009

City of Aspen

Combined Sales Tax and

Business License Application

and

Business Occupation Tax Return

130 South Galena Street

Aspen Colorado 81611

Please Type or Print Clearly

(970) 920-5029 E-mail: aspen_sales_tax@ci.aspen.co.us

Municipal Code Web Page: (

)

See Sections 14 & 23

Name of Business:

_____________________________________________________________

_____________________________________________________________

Sales Tax / Primary Mailing Address:

_______________________________________________________

_______________________________________________________

_______________________________________________________

Location Address: ________________

____________

Address To Which You Would Like Licenses Mailed:

____________________________

____Same as Sales Tax Address

____

____ Same as Location Address

____

Other: _______________________________

Phone No. of Business: (

) ______________________

Fax No.: (

) ____________________________

Sales Tax Contact: _________________________________

Contact Phone: _____________________________

E-mail Address: ____________________________________

Web Page Address: _________________________

Colorado Sales Tax License No: ____-__________________

If Being Applied For, Date? ____________________

If applicable, State of Colorado Sales Tax Exempt Number: ______________________________

Frequency of Filing Aspen Sales Tax Returns: ____ Monthly

____ Quarterly

____ Annual

____ Other (Describe)

If more than $600 in taxable sales per month, you must file monthly.

.

Will you also be collecting the Aspen 1% Lodging Tax on Short Term Rentals of Lodging? ______Yes

______ No

Nature of Business / Products

Sold: _____________________________________________________________________________

Type of Ownership: (check one)

______ Sole Proprietorship

______ Partnership

______ Corporation

LLC

Other

Date That Business Started In Aspen, or Date of Purchase of Business: _________________________

If Business Was Purchased, Name of Previous Business & Owner: _______________________________________

Names of Owners, Partners, or Managers of the Business:

a.___________________________________________________________ Title __________________

b.___________________________________________________________ Title __________________

c.___________________________________________________________ Title __________________

If Retail, Please Estimate the Highest Monthly Taxable Retail Sales For Your Business $_______________________

Estimated Monthly Average Full-Time Employees (FTE’s) of your Business: _________________________________

(Include self, owners and partners, managers, etc.)

Computation of Annual Business Occupation Tax Due to the City of Aspen

For the Calendar Year, January 1 thru December 31:

Amount Paid:

0 - 5 Employees.......................................................................................................$150

6 - 15 Employees.....................................................................................................$200

16 - 49 Employees...................................................................................................$400

$

.

50 or More Employees.............................................................................................$750

Liquor License Holders............................................................................................$ -0-

Not For Profit Groups....(IRS Section 501(C).(3) Certificate Required)...................$ -0-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2