Application For Extension Of Time To File Lansing Income Tax Return Form

ADVERTISEMENT

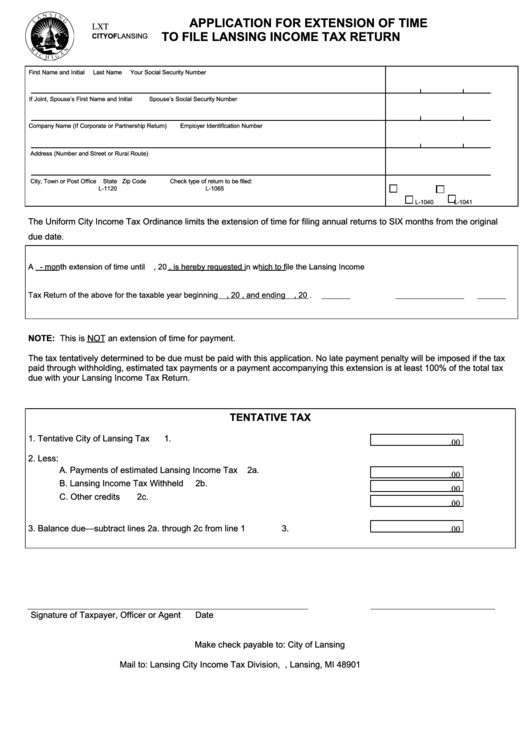

APPLICATION FOR EXTENSION OF TIME

LXT

TO FILE LANSING INCOME TAX RETURN

CITY OF LANSING

First Name and Initial

Last Name

Your Social Security Number

If Joint, Spouse’s First Name and Initial

Spouse’s Social Security Number

Company Name (If Corporate or Partnership Return)

Employer Identification Number

Address (Number and Street or Rural Route)

City, Town or Post Office

State

Zip Code

Check type of return to be filed:

L-1120

L-1065

L-1040

L-1041

The Uniform City Income Tax Ordinance limits the extension of time for filing annual returns to SIX months from the original

due date

.

A

- month extension of time until

, 20

, is hereby requested in which to file the Lansing Income

Tax Return of the above for the taxable year beginning

, 20

, and ending

, 20

.

NOTE: This is NOT an extension of time for payment.

The tax tentatively determined to be due must be paid with this application. No late payment penalty will be imposed if the tax

paid through withholding, estimated tax payments or a payment accompanying this extension is at least 100% of the total tax

due with your Lansing Income Tax Return.

TENTATIVE TAX

1. Tentative City of Lansing Tax

1.

.00

2. Less:

A. Payments of estimated Lansing Income Tax

2a.

.00

B. Lansing Income Tax Withheld

2b.

.00

C. Other credits

2c.

.00

3.

Balance due—subtract lines 2a. through 2c from line 1

3.

.00

Signature of Taxpayer, Officer or Agent

Date

Make check payable to: City of Lansing

Mail to: Lansing City Income Tax Division, P.O. Box 40752, Lansing, MI 48901

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1