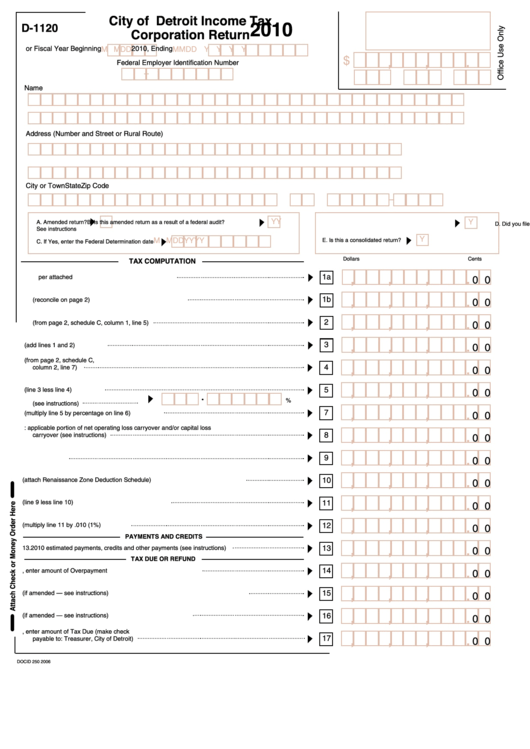

City of Detroit Income Tax

2010

D-1120

Corporation Return

or Fiscal Year Beginning

2010, Ending

M M D D

M M D D Y Y Y Y

$

,

,

.

Federal Employer Identification Number

Name

Address (Number and Street or Rural Route)

City or Town

State

Zip Code

Y

Y

Y

A. Amended return?

B. Is this amended return as a result of a federal audit?

D. Did you file a consolidated return with the IRS?

See instructions

Y

M M D D Y Y Y Y

E. Is this a consolidated return?

C. If Yes, enter the Federal Determination date

Dollars

Cents

TAX COMPUTATION

1. a.Taxable income before net operating loss deduction and special deductions

1a

,

,

,

.

per attached U.S. 1120 or 1120S as filed with IRS

0 0

1b

,

b. Income from attached schedule (reconcile on page 2)

,

,

.

0 0

2. Enter items not deductible under Detroit Income Tax Ordinance

2

,

,

,

.

(from page 2, schedule C, column 1, line 5)

0 0

3

,

,

,

.

3. TOTAL (add lines 1 and 2)

0 0

4. Enter items not taxable under Detroit Income Tax Ordinance (from page 2, schedule C,

4

column 2, line 7)

,

,

,

.

0 0

5

5. TOTAL (line 3 less line 4)

,

,

,

.

0 0

6. Apportionment percentage

%

(see instructions)

7

,

,

,

.

7. TOTAL (multiply line 5 by percentage on line 6)

0 0

8. LESS: applicable portion of net operating loss carryover and/or capital loss

8

carryover (see instructions)

,

,

,

.

0 0

9

9. Net income

,

,

,

.

0 0

10

10. Renaissance Zone Deduction (attach Renaissance Zone Deduction Schedule)

,

,

,

.

0 0

11. TOTAL Income subject to Tax (line 9 less line 10)

11

,

,

,

.

0 0

12. Tax (multiply line 11 by .010 (1%)

12

,

,

,

.

0 0

PAYMENTS AND CREDITS

13

13. 2010 estimated payments, credits and other payments (see instructions)

,

,

,

.

0 0

TAX DUE OR REFUND

14

14. If line 13 is larger than line 12, enter amount of Overpayment

,

,

,

.

0 0

15. Amount to be Credited to 2011 Estimated Tax (if amended — see instructions)

15

,

,

,

.

0 0

16. Amount to be Refunded (if amended — see instructions)

16

,

,

,

.

0 0

17. If line 12 is larger than line 13, enter amount of Tax Due (make check

17

,

,

,

.

payable to: Treasurer, City of Detroit)

0 0

DOCID 250 2006

1

1 2

2