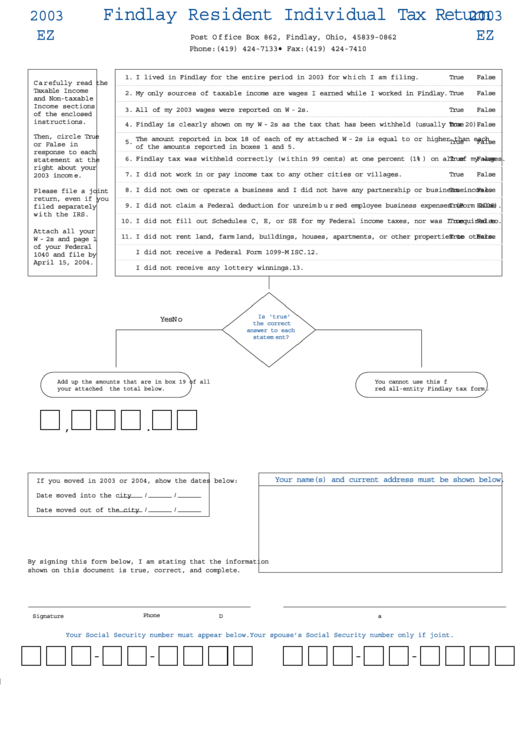

Form Ez - Findlay Resident Individual Tax Return - 2003

ADVERTISEMENT

Fi ndl ay R esi dent Indi vi dual Tax R etur n

2003

2003

EZ

EZ

Post O f f ice Box 862, Findlay, O hio, 45839-0862

Phone:(419) 424-7133 • Fax:(419) 424-7410

1.

I l i ved i n Fi ndl ay f or the enti r e per i od i n 2003 f or w hi ch I am fi l i ng.

Tr ue

Fal se

C ar eful l y r ead the

Taxabl e Incom e

2.

M y onl y sour ces of taxabl e i ncom e ar e w ages I ear ned w hi l e I w or ked i n Fi ndl ay.

Tr ue

Fal se

and N on- taxabl e

Income secti ons

3.

Al l of m y 2003 w ages w er e r epor ted on W - 2s.

Tr ue

Fal se

of the encl osed

i nstr ucti ons.

4.

Fi ndl ay i s cl ear l y show n on m y W - 2s as the tax that has been w i thhel d (usual l y box 20).

Tr ue

Fal se

Then, ci r cl e Tr ue

The am ount r epor ted i n box 18 of each of m y attached W - 2s i s equal to or hi gher than each

5.

Tr ue

Fal se

or Fal se i n

of the am ounts r epor ted i n boxes 1 and 5.

r esponse to each

6.

Fi ndl ay tax w as w i thhel d cor r ectl y ( w i thi n 99 cents) at one per cent ( 1% ) on al l of m y w ages.

Tr ue

Fal se

statement at the

r i ght about your

7.

I di d not w or k i n or pay i ncome tax to any other ci ti es or vi l l ages.

Tr ue

Fal se

2003 i ncom e.

8.

I di d not ow n or oper ate a busi ness and I di d not have any par tner shi p or busi ness i ncom e.

Tr ue

Fal se

Pl ease fi l e a j oi nt

r etur n, even i f you

9.

I di d not cl ai m a Feder al deducti on f or unr ei m bur sed em pl oyee busi ness expenses ( For m 2106) .

Tr ue

Fal se

fi l ed separ atel y

w i th the IR S.

10.

I di d not fi l l out Schedul es C, E, or SE f or m y Feder al i ncom e taxes, nor w as I r equi r ed to.

Tr ue

Fal se

Attach al l your

11.

I di d not r ent l and, f ar m l and, bui l di ngs, houses, apar tm ents, or other pr oper ti es to other s.

Tr ue

Fal se

W - 2s and page 1

of your Feder al

12.

I di d not r ecei ve a Feder al For m 1099- M ISC.

Tr ue

Fal se

1040 and fi l e by

Apr i l 15, 2004.

13.

I di d not r ecei ve any l otter y w i nni ngs.

Tr ue

Fal se

Is ‘tr ue’

Yes

N o

t he cor r ect

answer t o each

st at em ent ?

Add up t he amount s t hat are in box 19 of all

You cannot use thi s f or m .U se the

your at t ached W -2s.W r it e t he t ot al below.

r ed al l - enti ty Fi ndl ay tax f or m .

,

.

Your nam e(s) and cur r ent addr ess m ust be shown below .

I f you moved in 2003 or 2004, show t he dat es below:

Dat e moved int o t he cit y

Dat e moved out of t he cit y

By signing t his f or m below, I am st at ing t hat t he inf or mat ion

shown on t his document is t r ue, correct , and complet e.

Phone

Si gnatur e

D ate

Spouse’ s si gnatur e ( onl y i f j oi nt r etur n)

D ate

Your Social Security number m ust appear below .

Your spouse’ s Social Security number onl y if joint.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1