Form Dr 0222 - Cigarette Tax/tobacco Products Distributor Application - 2003

ADVERTISEMENT

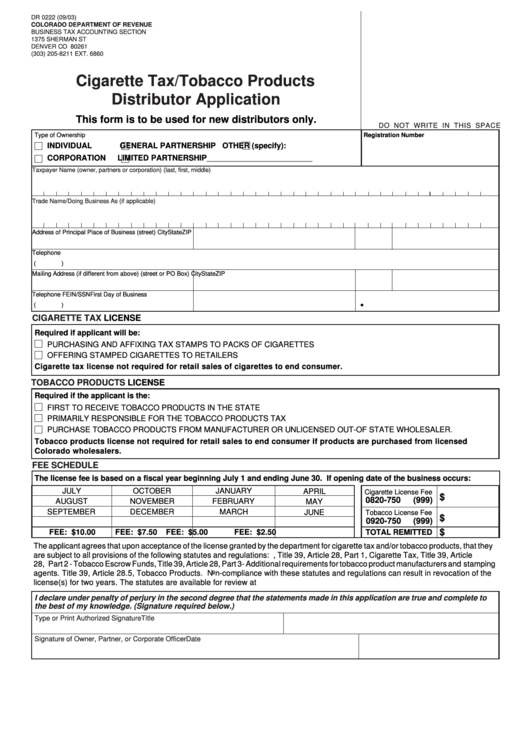

DR 0222 (09/03)

COLORADO DEPARTMENT OF REVENUE

BUSINESS TAX ACCOUNTING SECTION

1375 SHERMAN ST

DENVER CO 80261

(303) 205-8211 EXT. 6860

Cigarette Tax/ Tobacco Products

Distributor Application

This form is to be used for new distributors only.

DO NOT WRITE IN THIS SPACE

Type of Ownership

Registration Number

INDIVIDUAL

GENERAL PARTNERSHIP

OTHER (specify):

CORPORATION

LIMITED PARTNERSHIP

_______________________________

Taxpayer Name (owner, partners or corporation) (last, first, middle)

Trade Name/Doing Business As (if applicable)

Address of Principal Place of Business (street)

City

State

ZIP

Telephone

(

)

Mailing Address (if different from above) (street or PO Box) City

State

ZIP

Telephone

FEIN/SSN

First Day of Business

•

(

)

CIGARETTE TAX

LICENSE

Required if applicant will be:

PURCHASING AND AFFIXING TAX STAMPS TO PACKS OF CIGARETTES

OFFERING STAMPED CIGARETTES TO RETAILERS

Cigarette tax license not required for retail sales of cigarettes to end consumer.

TOBACCO PRODUCTS

LICENSE

Required if the applicant is the:

FIRST TO RECEIVE TOBACCO PRODUCTS IN THE STATE

PRIMARILY RESPONSIBLE FOR THE TOBACCO PRODUCTS TAX

PURCHASE TOBACCO PRODUCTS FROM MANUFACTURER OR UNLICENSED OUT-OF STATE WHOLESALER.

Tobacco products license not required for retail sales to end consumer if products are purchased from licensed

Colorado wholesalers.

FEE SCHEDULE

The license fee is based on a fiscal year beginning July 1 and ending June 30. If opening date of the business occurs:

JULY

OCTOBER

JANUARY

APRIL

Cigarette License Fee

$

0820-750

(999)

AUGUST

NOVEMBER

FEBRUARY

MAY

SEPTEMBER

DECEMBER

MARCH

JUNE

Tobacco License Fee

$

0920-750

(999)

$

FEE: $10.00

FEE: $7.50

FEE: $5.00

FEE: $2.50

TOTAL REMITTED

The applicant agrees that upon acceptance of the license granted by the department for cigarette tax and/or tobacco products, that they

are subject to all provisions of the following statutes and regulations: C.R.S., Title 39, Article 28, Part 1, Cigarette Tax, Title 39, Article

28, Part 2 - Tobacco Escrow Funds, Title 39, Article 28, Part 3- Additional requirements for tobacco product manufacturers and stamping

agents. Title 39, Article 28.5, Tobacco Products. Non-compliance with these statutes and regulations can result in revocation of the

license(s) for two years. The statutes are available for review at

I declare under penalty of perjury in the second degree that the statements made in this application are true and complete to

the best of my knowledge. (Signature required below.)

Type or Print Authorized Signature

Title

Signature of Owner, Partner, or Corporate Officer

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1