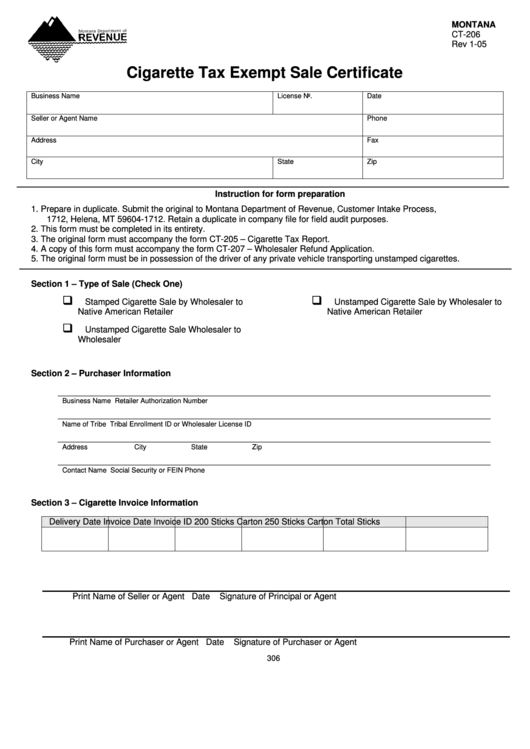

Form Ct-206 - Cigarette Tax Exempt Sale Certificate - 2005

ADVERTISEMENT

MONTANA

CT-206

Rev 1-05

Cigarette Tax Exempt Sale Certificate

Business Name

License No.

Date

Seller or Agent Name

Phone

Address

Fax

City

State

Zip

Instruction for form preparation

1. Prepare in duplicate. Submit the original to Montana Department of Revenue, Customer Intake Process, P.O. Box

1712, Helena, MT 59604-1712. Retain a duplicate in company file for field audit purposes.

2. This form must be completed in its entirety.

3. The original form must accompany the form CT-205 – Cigarette Tax Report.

4. A copy of this form must accompany the form CT-207 – Wholesaler Refund Application.

5. The original form must be in possession of the driver of any private vehicle transporting unstamped cigarettes.

Section 1 – Type of Sale (Check One)

Stamped Cigarette Sale by Wholesaler to

Unstamped Cigarette Sale by Wholesaler to

Native American Retailer

Native American Retailer

Unstamped Cigarette Sale Wholesaler to

Wholesaler

Section 2 – Purchaser Information

___________________________________________________________________________________________

Business Name

Retailer Authorization Number

___________________________________________________________________________________________

Name of Tribe

Tribal Enrollment ID or Wholesaler License ID

___________________________________________________________________________________________

Address

City

State

Zip

___________________________________________________________________________________________

Contact Name

Social Security or FEIN

Phone

Section 3 – Cigarette Invoice Information

Delivery Date

Invoice Date

Invoice ID

200 Sticks Carton

250 Sticks Carton

Total Sticks

Print Name of Seller or Agent

Date

Signature of Principal or Agent

Print Name of Purchaser or Agent

Date

Signature of Purchaser or Agent

306

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1