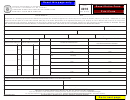

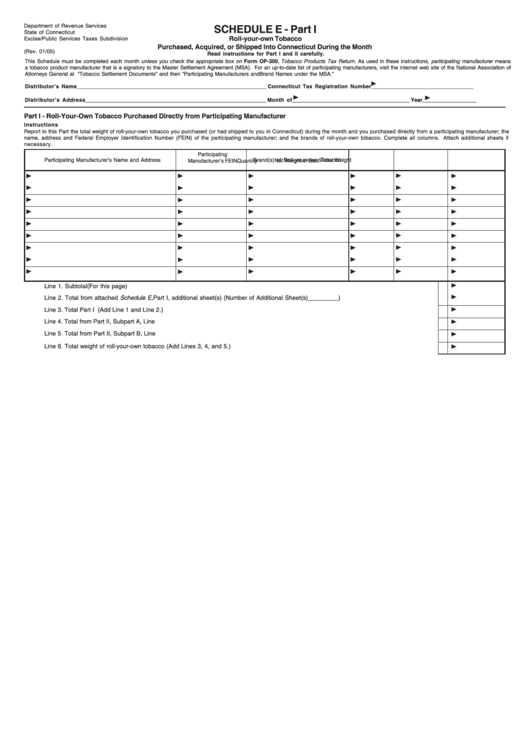

Schedule E - Part I - Roll-Your-Own Tobacco Purchased, Acquired, Or Shipped Into Connecticut During The Month

ADVERTISEMENT

Department of Revenue Services

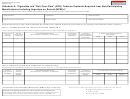

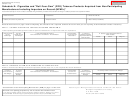

SCHEDULE E - Part I

State of Connecticut

Roll-your-own Tobacco

Excise/Public Services Taxes Subdivision

Purchased, Acquired, or Shipped Into Connecticut During the Month

(Rev. 01/05)

Read instructions for Part I and II carefully.

This Schedule must be completed each month unless you check the appropriate box on Form OP-300, Tobacco Products Tax Return. As used in these instructions, participating manufacturer means

a tobacco product manufacturer that is a signatory to the Master Settlement Agreement (MSA). For an up-to-date list of participating manufacturers, visit the internet web site of the National Association of

Attorneys General at and click on “Tobacco Settlement Documents” and then “Participating Manufacturers and Brand Names under the MSA.”

Distributor’s Name _______________________________________________________________ Connecticut Tax Registration Number __________________________________

Distributor’s Address ____________________________________________________________ Month of _______________________________________ Year __________________

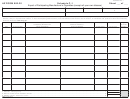

Part I - Roll-Your-Own Tobacco Purchased Directly from Participating Manufacturer

Instructions

Report in this Part the total weight of roll-your-own tobacco you purchased (or had shipped to you in Connecticut) during the month and you purchased directly from a participating manufacturer; the

name, address and Federal Employer Identification Number (FEIN) of the participating manufacturer; and the brands of roll-your-own tobacco. Complete all columns. Attach additional sheets if

necessary.

Participating

Participating Manufacturer’s Name and Address

Brand(s) of Roll-your-own Tobacco

Total Weight

Manufacturer’s FEIN

Net Weight of Each

Quantity

Line 1. Subtotal (For this page) ....................................................................................................................................................................................... 1

Line 2. Total from attached Schedule E, Part I, additional sheet(s) .... (Number of Additional Sheet(s) _________ ) ................................................ 2

Line 3. Total Part I (Add Line 1 and Line 2.) ................................................................................................................................................................... 3

Line 4. Total from Part II, Subpart A, Line 3 ..................................................................................................................................................................... 4

Line 5. Total from Part II, Subpart B, Line 3 ..................................................................................................................................................................... 5

Line 6. Total weight of roll-your-own tobacco (Add Lines 3, 4, and 5.) ........................................................................................................................... 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6