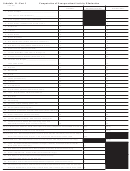

Schedule O - Computation Of Nonoperational Activity Elimination Page 3

ADVERTISEMENT

Schedule O - Part III

Computation of Tax Due on Nonoperational Activity

(7/06, R-5)

ACTIVITY

ACTIVITY

TOTAL

____________________

_____________________

1. Gross receipts ________________________________

Less returns and allowances_____________________

1.

1.

1.

2. Cost of goods sold and/or operations

2.

2.

2.

3. Gross Profit - Subtract Line 2 from Line 1.

3.

3.

3.

4. Dividends

4.

4.

4.

5. Interest

5.

5.

5.

6. Gross Rents

6.

6.

6.

7. Gross Royalties

7.

7.

7.

8. Net Capital Gain (attach Federal Schedule D)

8.

8.

8.

9. Net Gain or (Loss) (attach Federal Form 4797)

9.

9.

9.

10. Other Income (attach schedule)

10.

10.

10.

11. TOTAL INCOME - Add Lines 3 through 10

11.

11.

11.

12. Compensation of Officers (Schedule F-1)

12.

12.

12.

13. Salaries and Wages ___________________________

Less Jobs Credit______________________________

13.

13.

13.

14. Repairs

14.

14.

14.

15. Bad Debts

15.

15.

15.

16. Rents

16.

16.

16.

17. Taxes (Schedule H)

17.

17.

17.

18. Interest

18.

18.

18.

19. Contributions

19.

19.

19.

20a. Depreciation (attach Federal Form 4562)

20a.

20a.

20a.

20b. Less: Depreciation claimed elsewhere

20b.

20b.

20b.

21. Depletion

21.

21.

21.

22. Advertising

22.

22.

22.

23. Pension, Profit-sharing plans, etc.

23.

23.

23.

24. Employee benefit programs

24.

24.

24.

25. Domestic production activities deduction (CBT-100 only) 25.

25.

25.

26. Other deductions (attach schedule)

26.

26.

26.

27. TOTAL DEDUCTIONS - Add Lines 12 through 26

27.

27.

27.

28. Net Nonoperational Income before Net Operating Loss

and Special Deductions (Line 11 minus Line 27)

28.

28.

28.

29a. Interest from Federal, State, Municipal and other

obligations not included above

29a.

29a.

29a.

29b. Expenses from Income in Line 29(a) and not

included in Line 28 above

29b.

29b.

29b.

30. Net Current Years Nonoperational Income (Line 28

plus Line 29(a) minus Line 29(b))

30.

30.

30.

31. NEW JERSEY’S TAXABLE PORTION - attach

schedule of computation (See Instruction 5). Carry

total to Line 4(b) of Form CBT-100 or CBT-100S.

31.

31.

31.

32. Listing of states where Nonoperational Income is being assigned:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3