Individual Return (For Resident And Non-Resident) - City Of Jackson - 2005

ADVERTISEMENT

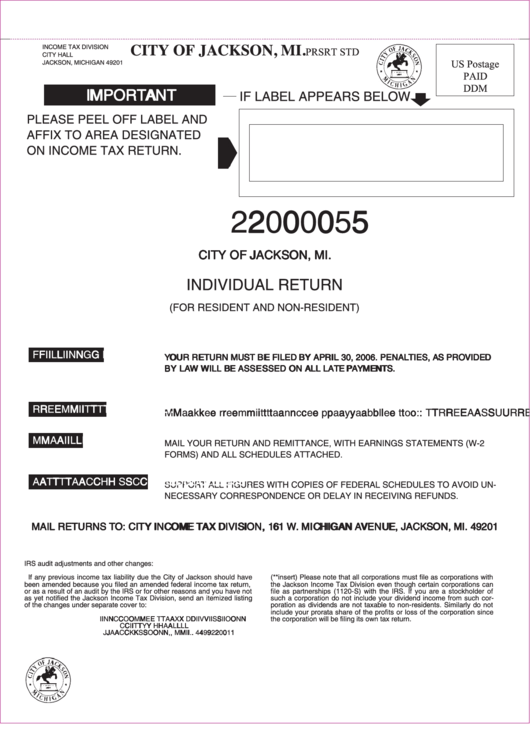

CITY OF JACKSON, MI.

INCOME TAX DIVISION

PRSRT STD

CITY HALL

JACKSON, MICHIGAN 49201

US Postage

PAID

DDM

I I M M P P O O R R T T A A N N T T

IF LABEL APPEARS BELOW

| |

PLEASE PEEL OFF LABEL AND

AFFIX TO AREA DESIGNATED

ON INCOME TAX RETURN.

2 2 0 0 0 0 5 5

C C I I T T Y Y O O F F J J A A C C K K S S O O N N , , M M I I . .

INDIVIDUAL RETURN

(FOR RESIDENT AND NON-RESIDENT)

F F I I L L I I N N G G D D A A T T E E : :

Y Y O O U U R R R R E E T T U U R R N N M M U U S S T T B B E E F F I I L L E E D D B B Y Y A A P P R R I I L L 3 3 0 0 , , 2 2 0 0 0 0 6 6 . . P P E E N N A A L L T T I I E E S S , , A A S S P P R R O O V V I I D D E E D D

B B Y Y L L A A W W W W I I L L L L B B E E A A S S S S E E S S S S E E D D O O N N A A L L L L L L A A T T E E P P A A Y Y M M E E N N T T S S . .

R R E E M M I I T T T T A A N N C C E E : :

M M a a k k e e r r e e m m i i t t t t a a n n c c e e p p a a y y a a b b l l e e t t o o : : T T R R E E A A S S U U R R E E R R , , C C I I T T Y Y O O F F J J A A C C K K S S O O N N

M M A A I I L L I I N N G G : :

MAIL YOUR RETURN AND REMITTANCE, WITH EARNINGS STATEMENTS (W-2

FORMS) AND ALL SCHEDULES ATTACHED.

A A T T T T A A C C H H S S C C H H E E D D U U L L E E S S : :

SUPPORT ALL FIGURES WITH COPIES OF FEDERAL SCHEDULES TO AVOID UN-

NECESSARY CORRESPONDENCE OR DELAY IN RECEIVING REFUNDS.

M M A A I I L L R R E E T T U U R R N N S S T T O O : : C C I I T T Y Y I I N N C C O O M M E E T T A A X X D D I I V V I I S S I I O O N N , , 1 1 6 6 1 1 W W . . M M I I C C H H I I G G A A N N A A V V E E N N U U E E , , J J A A C C K K S S O O N N , , M M I I . . 4 4 9 9 2 2 0 0 1 1

IRS audit adjustments and other changes:

If any previous income tax liability due the City of Jackson should have

(**insert) Please note that all corporations must file as corporations with

been amended because you filed an amended federal income tax return,

the Jackson Income Tax Division even though certain corporations can

or as a result of an audit by the IRS or for other reasons and you have not

file as partnerships (1120-S) with the IRS. If you are a stockholder of

as yet notified the Jackson Income Tax Division, send an itemized listing

such a corporation do not include your dividend income from such cor-

of the changes under separate cover to:

poration as dividends are not taxable to non-residents. Similarly do not

include your prorata share of the profits or loss of the corporation since

I I N N C C O O M M E E T T A A X X D D I I V V I I S S I I O O N N

the corporation will be filing its own tax return.

C C I I T T Y Y H H A A L L L L

J J A A C C K K S S O O N N , , M M I I . . 4 4 9 9 2 2 0 0 1 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4