Form 41a720-S40 - Schedule Keoz - Tax Credit Computation Schedule (For A Keoz Project Of A Corporation) - 2010 - Commonwealth Of Kentucky Department Of Revenue

ADVERTISEMENT

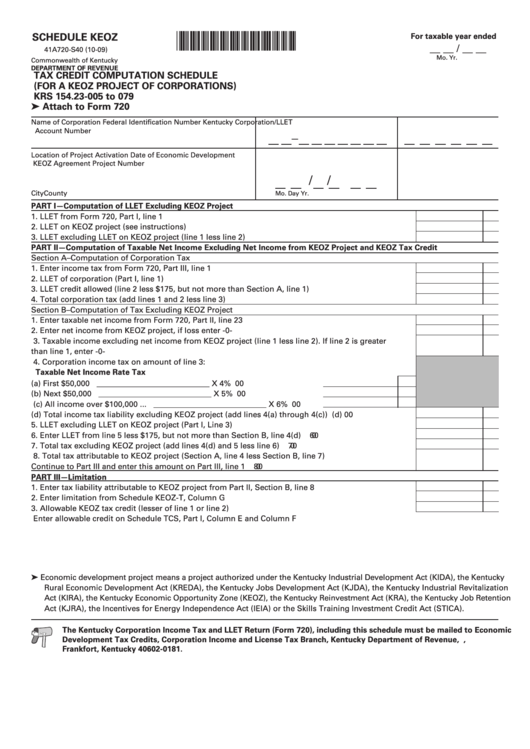

SCHEDULE KEOZ

*0900010238*

For taxable year ended

__ __ / __ __

41A720-S40 (10-09)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

TAX CREDIT COMPUTATION SCHEDULE

(FOR A KEOZ PROJECT OF CORPORATIONS)

KRS 154.23-005 to 079

➤ Attach to Form 720

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET

Account Number

—

Location of Project

Activation Date of

Economic Development

KEOZ Agreement

Project Number

/

/

Mo.

Day

Yr.

City

County

PART I—Computation of LLET Excluding KEOZ Project

1. LLET from Form 720, Part I, line 1 .......................................................................................................... 1

00

2. LLET on KEOZ project (see instructions) ............................................................................................... 2

00

3. LLET excluding LLET on KEOZ project (line 1 less line 2) .................................................................... 3

00

PART II—Computation of Taxable Net Income Excluding Net Income from KEOZ Project and KEOZ Tax Credit

Section A–Computation of Corporation Tax

1. Enter income tax from Form 720, Part III, line 1 .................................................................................... 1

00

2. LLET of corporation (Part I, line 1) .......................................................................................................... 2

00

3. LLET credit allowed (line 2 less $175, but not more than Section A, line 1) ....................................... 3

00

4. Total corporation tax (add lines 1 and 2 less line 3) ............................................................................. 4

00

Section B–Computation of Tax Excluding KEOZ Project

1. Enter taxable net income from Form 720, Part II, line 23 ..................................................................... 1

00

2. Enter net income from KEOZ project, if loss enter -0- .......................................................................... 2

00

3. Taxable income excluding net income from KEOZ project (line 1 less line 2). If line 2 is greater

than line 1, enter -0- ................................................................................................................................ 3

00

4. Corporation income tax on amount of line 3:

Taxable Net Income

Rate

Tax

(a) First $50,000 .......................

_____________________________

X 4%

00

_____________________________

(b) Next $50,000 .......................

X 5%

00

_____________________________

(c) All income over $100,000 ...

X 6%

00

(d) Total income tax liability excluding KEOZ project (add lines 4(a) through 4(c)) .......................... 4(d)

00

5. LLET excluding LLET on KEOZ project (Part I, Line 3) ..........................................................................

5

00

6. Enter LLET from line 5 less $175, but not more than Section B, line 4(d) ..........................................

6

00

7. Total tax excluding KEOZ project (add lines 4(d) and 5 less line 6) ....................................................

7

00

8. Total tax attributable to KEOZ project (Section A, line 4 less Section B, line 7)

Continue to Part III and enter this amount on Part III, line 1 ................................................................

8

00

PART III—Limitation

1. Enter tax liability attributable to KEOZ project from Part II, Section B, line 8 .................................... 1

00

2. Enter limitation from Schedule KEOZ-T, Column G .............................................................................. 2

00

3. Allowable KEOZ tax credit (lesser of line 1 or line 2) ........................................................................... 3

00

Enter allowable credit on Schedule TCS, Part I, Column E and Column F

➤ Economic development project means a project authorized under the Kentucky Industrial Development Act (KIDA), the Kentucky

Rural Economic Development Act (KREDA), the Kentucky Jobs Development Act (KJDA), the Kentucky Industrial Revitalization

Act (KIRA), the Kentucky Economic Opportunity Zone (KEOZ), the Kentucky Reinvestment Act (KRA), the Kentucky Job Retention

Act (KJRA), the Incentives for Energy Independence Act (IEIA) or the Skills Training Investment Credit Act (STICA).

The Kentucky Corporation Income Tax and LLET Return (Form 720), including this schedule must be mailed to Economic

Development Tax Credits, Corporation Income and License Tax Branch, Kentucky Department of Revenue, P .O. Box 181,

Frankfort, Kentucky 40602-0181.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1