Instructions For Form L-3 - Employer'S Annual Reconciliation Of Louisiana Withholding Tax - 2009

ADVERTISEMENT

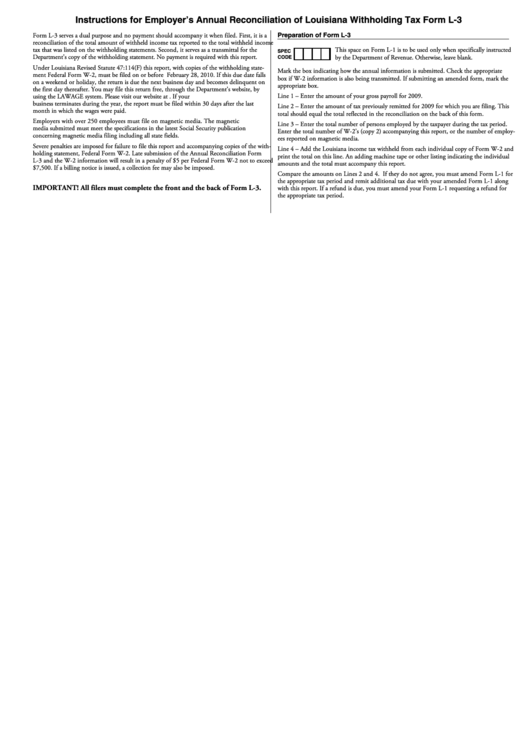

Instructions for Employer’s Annual Reconciliation of Louisiana Withholding Tax Form L-3

Form L-3 serves a dual purpose and no payment should accompany it when filed. First, it is a

Preparation of Form L-3

reconciliation of the total amount of withheld income tax reported to the total withheld income

tax that was listed on the withholding statements. Second, it serves as a transmittal for the

This space on Form L-1 is to be used only when specifically instructed

SPEC

Department’s copy of the withholding statement. No payment is required with this report.

by the Department of Revenue. Otherwise, leave blank.

CODE

Under Louisiana Revised Statute 47:114(F) this report, with copies of the withholding state-

Mark the box indicating how the annual information is submitted. Check the appropriate

ment Federal Form W-2, must be filed on or before February 28, 2010. If this due date falls

box if W-2 information is also being transmitted. If submitting an amended form, mark the

on a weekend or holiday, the return is due the next business day and becomes delinquent on

appropriate box.

the first day thereafter. You may file this return free, through the Department’s website, by

Line 1 – Enter the amount of your gross payroll for 2009.

using the LAWAGE system. Please visit our website at If your

business terminates during the year, the report must be filed within 30 days after the last

Line 2 – Enter the amount of tax previously remitted for 2009 for which you are filing. This

month in which the wages were paid.

total should equal the total reflected in the reconciliation on the back of this form.

Employers with over 250 employees must file on magnetic media. The magnetic

Line 3 – Enter the total number of persons employed by the taxpayer during the tax period.

media submitted must meet the specifications in the latest Social Security publication

Enter the total number of W-2’s (copy 2) accompanying this report, or the number of employ-

concerning magnetic media filing including all state fields.

ees reported on magnetic media.

Severe penalties are imposed for failure to file this report and accompanying copies of the with-

Line 4 – Add the Louisiana income tax withheld from each individual copy of Form W-2 and

holding statement, Federal Form W-2. Late submission of the Annual Reconciliation Form

print the total on this line. An adding machine tape or other listing indicating the individual

L-3 and the W-2 information will result in a penalty of $5 per Federal Form W-2 not to exceed

amounts and the total must accompany this report.

$7,500. If a billing notice is issued, a collection fee may also be imposed.

Compare the amounts on Lines 2 and 4. If they do not agree, you must amend Form L-1 for

the appropriate tax period and remit additional tax due with your amended Form L-1 along

IMPORTANT! All filers must complete the front and the back of Form L-3.

with this report. If a refund is due, you must amend your Form L-1 requesting a refund for

the appropriate tax period.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2