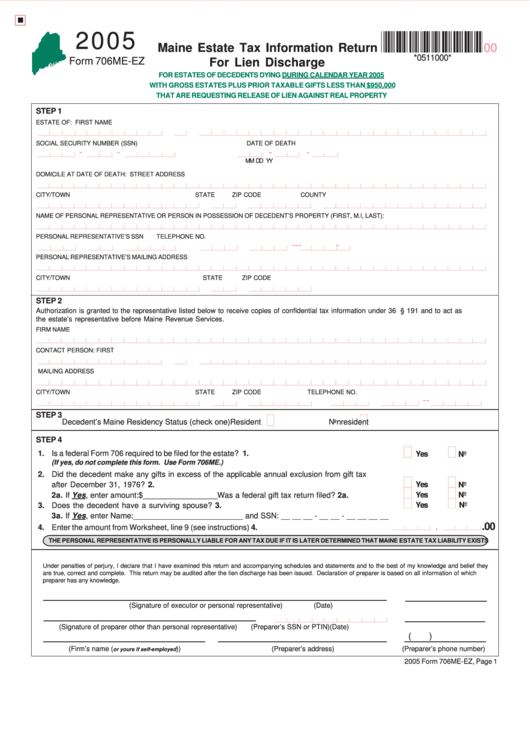

Form 706me-Ez - Maine Estate Tax Information Return For Lien Discharge - 2005

ADVERTISEMENT

2005

Maine Estate Tax Information Return

00

*0511000*

Form 706ME-EZ

For Lien Discharge

FOR ESTATES OF DECEDENTS DYING DURING CALENDAR YEAR 2005

WITH GROSS ESTATES PLUS PRIOR TAXABLE GIFTS LESS THAN $950,000

THAT ARE REQUESTING RELEASE OF LIEN AGAINST REAL PROPERTY

STEP 1

ESTATE OF: FIRST NAME

M.I.

LAST NAME

SOCIAL SECURITY NUMBER (SSN)

DATE OF DEATH

-

-

-

-

MM

DD

YY

DOMICILE AT DATE OF DEATH: STREET ADDRESS

CITY/TOWN

STATE

ZIP CODE

COUNTY

NAME OF PERSONAL REPRESENTATIVE OR PERSON IN POSSESSION OF DECEDENT’S PROPERTY (FIRST, M.I, LAST):

PERSONAL REPRESENTATIVE’S SSN

TELEPHONE NO.

-

-

-

-

PERSONAL REPRESENTATIVE’S MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

STEP 2

Authorization is granted to the representative listed below to receive copies of confidential tax information under 36 M.R.S.A. § 191 and to act as

the estate’s representative before Maine Revenue Services.

FIRM NAME

CONTACT PERSON: FIRST

M.I.

LAST

MAILING ADDRESS

CITY/TOWN

STATE

ZIP CODE

TELEPHONE NO.

-

-

STEP 3

Decedent’s Maine Residency Status (check one)

Resident

Nonresident

STEP 4

1. Is a federal Form 706 required to be filed for the estate? .................................................................. 1.

Yes

No

(If yes, do not complete this form. Use Form 706ME.)

2. Did the decedent make any gifts in excess of the applicable annual exclusion from gift tax

Yes

No

after December 31, 1976? ............................................................................................................. 2.

2a. If Yes, enter amount:$ _________________ Was a federal gift tax return filed? ................ 2a.

Yes

No

Yes

No

3. Does the decedent have a surviving spouse? .............................................................................. 3.

3a. If Yes, enter Name: _________________________ and SSN: __ __ __ - __ __ - __ __ __ __

,

.00

4. Enter the amount from Worksheet, line 9 (see instructions) ............................................................. 4.

THE PERSONAL REPRESENTATIVE IS PERSONALLY LIABLE FOR ANY TAX DUE IF IT IS LATER DETERMINED THAT MAINE ESTATE TAX LIABILITY EXISTS

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements and to the best of my knowledge and belief they

are true, correct and complete. This return may be audited after the lien discharge has been issued. Declaration of preparer is based on all information of which

preparer has any knowledge.

(Signature of executor or personal representative)

(Date)

(Signature of preparer other than personal representative)

(Preparer’s SSN or PTIN)

(Date)

(

)

(Firm’s name (

))

(Preparer’s address)

(Preparer’s phone number)

or yours if self-employed

2005 Form 706ME-EZ, Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2