Instructions And Guidelines For Preparing Rural Small Business Capital Company Report For Investors

ADVERTISEMENT

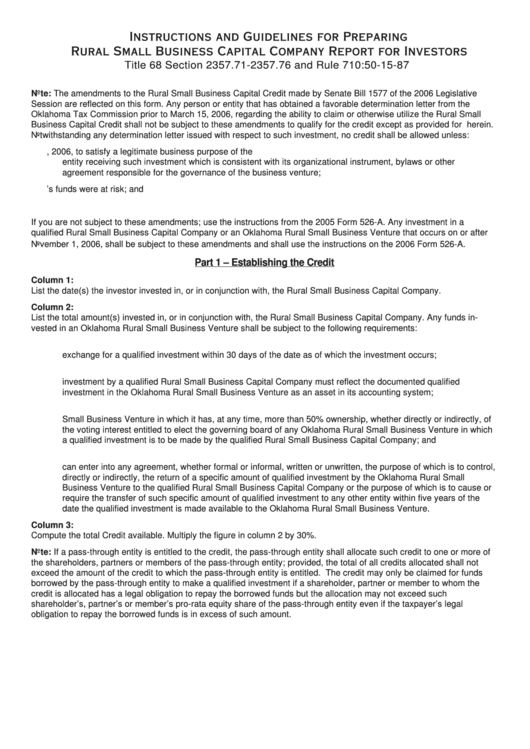

Instructions and Guidelines for Preparing

Rural Small Business Capital Company Report for Investors

Title 68 Section 2357.71-2357.76 and Rule 710:50-15-87

Note: The amendments to the Rural Small Business Capital Credit made by Senate Bill 1577 of the 2006 Legislative

Session are reflected on this form. Any person or entity that has obtained a favorable determination letter from the

Oklahoma Tax Commission prior to March 15, 2006, regarding the ability to claim or otherwise utilize the Rural Small

Business Capital Credit shall not be subject to these amendments to qualify for the credit except as provided for herein.

Notwithstanding any determination letter issued with respect to such investment, no credit shall be allowed unless:

1. Such qualified investment is made prior to November 1, 2006, to satisfy a legitimate business purpose of the

entity receiving such investment which is consistent with its organizational instrument, bylaws or other

agreement responsible for the governance of the business venture;

2. The investor’s funds were at risk; and

3. The investment was not made chiefly for the purpose of reducing tax liability.

If you are not subject to these amendments; use the instructions from the 2005 Form 526-A. Any investment in a

qualified Rural Small Business Capital Company or an Oklahoma Rural Small Business Venture that occurs on or after

November 1, 2006, shall be subject to these amendments and shall use the instructions on the 2006 Form 526-A.

Part 1 – Establishing the Credit

Column 1:

List the date(s) the investor invested in, or in conjunction with, the Rural Small Business Capital Company.

Column 2:

List the total amount(s) invested in, or in conjunction with, the Rural Small Business Capital Company. Any funds in-

vested in an Oklahoma Rural Small Business Venture shall be subject to the following requirements:

1. The Oklahoma Rural Small Business Venture must issue its equity securities or subordinated debt instruments in

exchange for a qualified investment within 30 days of the date as of which the investment occurs;

2. The qualified Rural Small Business Capital Company or any entity making an investment in conjunction with

investment by a qualified Rural Small Business Capital Company must reflect the documented qualified

investment in the Oklahoma Rural Small Business Venture as an asset in its accounting system;

3. The qualified Rural Small Business Capital Company shall not make a qualified investment in an Oklahoma

Small Business Venture in which it has, at any time, more than 50% ownership, whether directly or indirectly, of

the voting interest entitled to elect the governing board of any Oklahoma Rural Small Business Venture in which

a qualified investment is to be made by the qualified Rural Small Business Capital Company; and

4. Neither the qualified Rural Small Business Capital Company nor the Oklahoma Rural Small Business Venture

can enter into any agreement, whether formal or informal, written or unwritten, the purpose of which is to control,

directly or indirectly, the return of a specific amount of qualified investment by the Oklahoma Rural Small

Business Venture to the qualified Rural Small Business Capital Company or the purpose of which is to cause or

require the transfer of such specific amount of qualified investment to any other entity within five years of the

date the qualified investment is made available to the Oklahoma Rural Small Business Venture.

Column 3:

Compute the total Credit available. Multiply the figure in column 2 by 30%.

Note: If a pass-through entity is entitled to the credit, the pass-through entity shall allocate such credit to one or more of

the shareholders, partners or members of the pass-through entity; provided, the total of all credits allocated shall not

exceed the amount of the credit to which the pass-through entity is entitled. The credit may only be claimed for funds

borrowed by the pass-through entity to make a qualified investment if a shareholder, partner or member to whom the

credit is allocated has a legal obligation to repay the borrowed funds but the allocation may not exceed such

shareholder’s, partner’s or member’s pro-rata equity share of the pass-through entity even if the taxpayer’s legal

obligation to repay the borrowed funds is in excess of such amount.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2