Form Dr-907n - Inormation For Filing Insurance Premium Installment Payment

ADVERTISEMENT

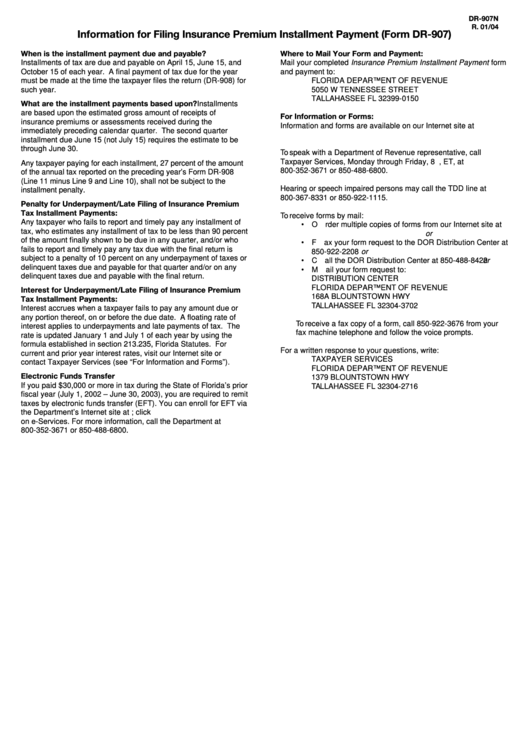

DR-907N

R. 01/04

Information for Filing Insurance Premium Installment Payment (Form DR-907)

When is the installment payment due and payable?

Where to Mail Your Form and Payment:

Mail your completed Insurance Premium Installment Payment form

Installments of tax are due and payable on April 15, June 15, and

October 15 of each year. A final payment of tax due for the year

and payment to:

must be made at the time the taxpayer files the return (DR-908) for

FLORIDA DEPARTMENT OF REVENUE

such year.

5050 W TENNESSEE STREET

TALLAHASSEE FL 32399-0150

What are the installment payments based upon? Installments

are based upon the estimated gross amount of receipts of

For Information or Forms:

insurance premiums or assessments received during the

Information and forms are available on our Internet site at

immediately preceding calendar quarter. The second quarter

installment due June 15 (not July 15) requires the estimate to be

through June 30.

To speak with a Department of Revenue representative, call

Taxpayer Services, Monday through Friday, 8 a.m. to 7 p.m., ET, at

Any taxpayer paying for each installment, 27 percent of the amount

800-352-3671 or 850-488-6800.

of the annual tax reported on the preceding year’s Form DR-908

(Line 11 minus Line 9 and Line 10), shall not be subject to the

Hearing or speech impaired persons may call the TDD line at

installment penalty.

800-367-8331 or 850-922-1115.

Penalty for Underpayment/Late Filing of Insurance Premium

Tax Installment Payments:

To receive forms by mail:

Any taxpayer who fails to report and timely pay any installment of

• Order multiple copies of forms from our Internet site at

tax, who estimates any installment of tax to be less than 90 percent

/forms or

of the amount finally shown to be due in any quarter, and/or who

• Fax your form request to the DOR Distribution Center at

fails to report and timely pay any tax due with the final return is

850-922-2208 or

subject to a penalty of 10 percent on any underpayment of taxes or

• Call the DOR Distribution Center at 850-488-8422 or

delinquent taxes due and payable for that quarter and/or on any

• Mail your form request to:

delinquent taxes due and payable with the final return.

DISTRIBUTION CENTER

FLORIDA DEPARTMENT OF REVENUE

Interest for Underpayment/Late Filing of Insurance Premium

168A BLOUNTSTOWN HWY

Tax Installment Payments:

TALLAHASSEE FL 32304-3702

Interest accrues when a taxpayer fails to pay any amount due or

any portion thereof, on or before the due date. A floating rate of

To receive a fax copy of a form, call 850-922-3676 from your

interest applies to underpayments and late payments of tax. The

fax machine telephone and follow the voice prompts.

rate is updated January 1 and July 1 of each year by using the

formula established in section 213.235, Florida Statutes. For

For a written response to your questions, write:

current and prior year interest rates, visit our Internet site or

TAXPAYER SERVICES

contact Taxpayer Services (see “For Information and Forms”).

FLORIDA DEPARTMENT OF REVENUE

Electronic Funds Transfer

1379 BLOUNTSTOWN HWY

If you paid $30,000 or more in tax during the State of Florida’s prior

TALLAHASSEE FL 32304-2716

fiscal year (July 1, 2002 – June 30, 2003), you are required to remit

taxes by electronic funds transfer (EFT). You can enroll for EFT via

the Department’s Internet site at ; click

on e-Services. For more information, call the Department at

800-352-3671 or 850-488-6800.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1