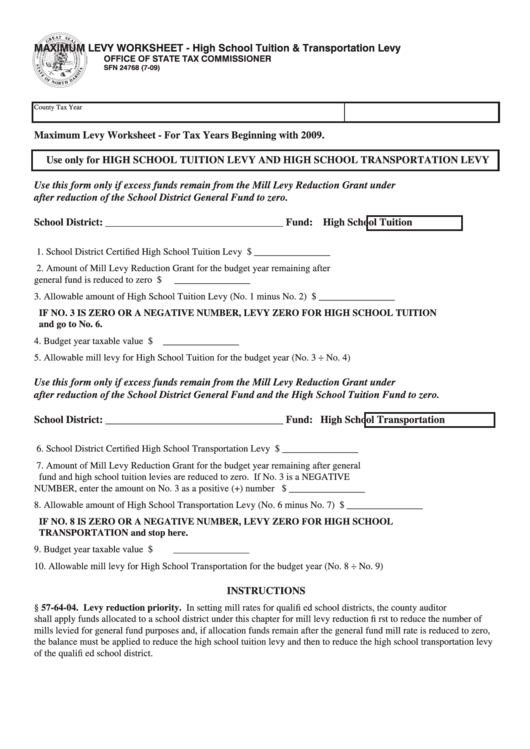

MAXIMUM LEVY WORKSHEET - High School Tuition & Transportation Levy

OFFICE OF STATE TAX COMMISSIONER

SFN 24768 (7-09)

County

Tax Year

Maximum Levy Worksheet - For Tax Years Beginning with 2009.

Use only for HIGH SCHOOL TUITION LEVY AND HIGH SCHOOL TRANSPORTATION LEVY

Use this form only if excess funds remain from the Mill Levy Reduction Grant under N.D.C.C. ch. 57-64

after reduction of the School District General Fund to zero.

School District: __________________________________

Fund: High School Tuition

1. School District Certifi ed High School Tuition Levy ..................................................................$

________________

2. Amount of Mill Levy Reduction Grant for the budget year remaining after

general fund is reduced to zero ..................................................................................................$

________________

3. Allowable amount of High School Tuition Levy (No. 1 minus No. 2) ......................................$

________________

IF NO. 3 IS ZERO OR A NEGATIVE NUMBER, LEVY ZERO FOR HIGH SCHOOL TUITION

and go to No. 6.

4. Budget year taxable value ..........................................................................................................

$ ________________

5. Allowable mill levy for High School Tuition for the budget year (No. 3 ÷ No. 4)....................

________________

Use this form only if excess funds remain from the Mill Levy Reduction Grant under N.D.C.C. ch. 57-64

after reduction of the School District General Fund and the High School Tuition Fund to zero.

School District: __________________________________

Fund: High School Transportation

6. School District Certifi ed High School Transportation Levy ......................................................$

________________

7. Amount of Mill Levy Reduction Grant for the budget year remaining after general

fund and high school tuition levies are reduced to zero. If No. 3 is a NEGATIVE

NUMBER, enter the amount on No. 3 as a positive (+) number ..............................................$

________________

8. Allowable amount of High School Transportation Levy (No. 6 minus No. 7) ..........................$

________________

IF NO. 8 IS ZERO OR A NEGATIVE NUMBER, LEVY ZERO FOR HIGH SCHOOL

TRANSPORTATION and stop here.

9. Budget year taxable value ..........................................................................................................$

________________

10. Allowable mill levy for High School Transportation for the budget year (No. 8 ÷ No. 9) ........

________________

INSTRUCTIONS

N.D.C.C. § 57-64-04. Levy reduction priority. In setting mill rates for qualifi ed school districts, the county auditor

shall apply funds allocated to a school district under this chapter for mill levy reduction fi rst to reduce the number of

mills levied for general fund purposes and, if allocation funds remain after the general fund mill rate is reduced to zero,

the balance must be applied to reduce the high school tuition levy and then to reduce the high school transportation levy

of the qualifi ed school district.

1

1