Form Dw-3 - Reconciliation Of Withholding Returns - City Of Dayton

ADVERTISEMENT

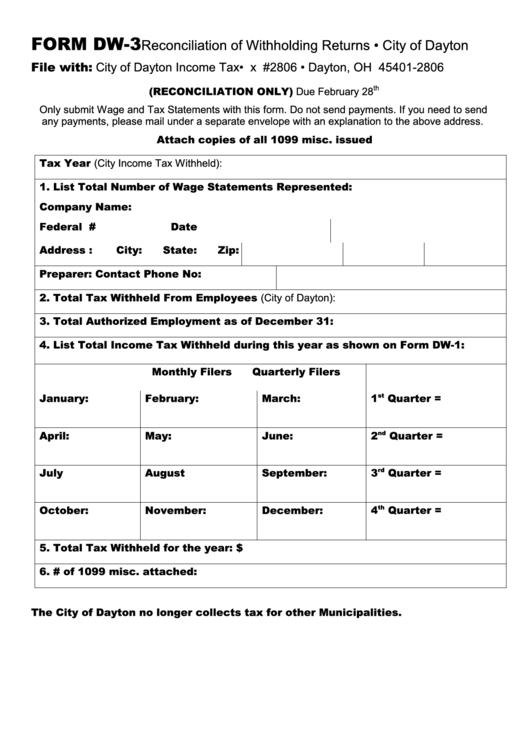

FORM DW-3

Reconciliation of Withholding Returns • City of Dayton

File with: City of Dayton Income Tax • P.O. Box #2806 • Dayton, OH 45401-2806

(RECONCILIATION ONLY) Due February 28

th

Only submit Wage and Tax Statements with this form. Do not send paymen ts. If you need to send

any payments, please mail under a separate envelope with an explanation to the above address.

Attach copies of all 1099 misc. issued

Tax Year (City Income Tax Withheld):

1. List Total Number of Wage Statements Represented:

Company Name:

Federal I.D. #

Date

Address :

City:

State:

Zip:

Preparer:

Contact Phone No:

2. Total Tax Withheld From Employees (City of Dayton):

3. Total Authorized Employment as of December 31:

4. List Total Income Tax Withheld during this year as shown on Form DW-1:

Monthly Filers

Quarterly Filers

January:

February:

March:

1

Quarter =

st

April:

May:

June:

2

Quarter =

nd

July

August

September:

3

Quarter =

rd

October:

November:

December:

4

Quarter =

th

5. Total Tax Withheld for the year: $

6. # of 1099 misc. attached:

The City of Dayton no longer collects tax for other Municipalities.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1