Schedule D Individual - Capital Assets Gains And Losses Form - 2010

ADVERTISEMENT

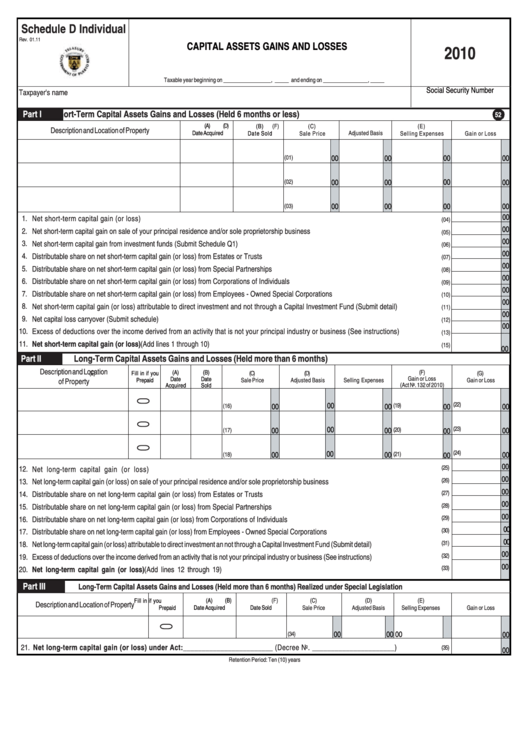

Schedule D Individual

Rev. 01.11

CAPITAL ASSETS GAINS AND LOSSES

2010

Taxable year beginning on _________________, _____ and ending on ________________, _____

Social Security Number

Taxpayer's name

Part I

Short-Term Capital Assets Gains and Losses (Held 6 months or less)

52

(A)

(D)

(B)

(C)

(E)

(F)

Description and Location of Property

Date Acquired

Date Sold

Sale Price

Adjusted Basis

Selling Expenses

Gain or Loss

00

00

00

00

(01)

00

00

00

00

(02)

00

00

00

00

(03)

00

1.

Net short-term capital gain (or loss) ...................................................................................................................................................

(04)

00

2.

Net short-term capital gain on sale of your principal residence and/or sole proprietorship business .......................................................................

(05)

00

3.

Net short-term capital gain from investment funds (Submit Schedule Q1) ...............................................................................................................

(06)

00

4.

Distributable share on net short-term capital gain (or loss) from Estates or Trusts ..................................................................................................

(07)

00

5.

Distributable share on net short-term capital gain (or loss) from Special Partnerships ............................................................................................

(08)

00

6.

Distributable share on net short-term capital gain (or loss) from Corporations of Individuals ..................................................................................

(09)

00

7.

Distributable share on net short-term capital gain (or loss) from Employees - Owned Special Corporations ..........................................................

(10)

00

8.

Net short-term capital gain (or loss) attributable to direct investment and not through a Capital Investment Fund (Submit detail) ......................

(11)

00

9.

Net capital loss carryover (Submit schedule) ............................................................................................................................................................

(12)

00

10.

Excess of deductions over the income derived from an activity that is not your principal industry or business (See instructions) .....................

(13)

11.

Net short-term capital gain (or loss) (Add lines 1 through 10) ..............................................................................................................................

(15)

00

Part II

Long-Term Capital Assets Gains and Losses (Held more than 6 months)

Description and Location

(A)

(B)

(F)

Fill in if you

(C)

(D)

(E)

(G)

Gain or Loss

Date

Date

of Property

Prepaid

Sale Price

Adjusted Basis

Selling Expenses

Gain or Loss

(Act No. 132 of 2010)

Acquired

Sold

(22)

00

00

00

(19)

00

(16)

00

(23)

00

(20)

(17)

00

00

00

00

00

(24)

00

00

(21)

00

00

(18)

00

(25)

12.

Net long-term capital gain (or loss) ...........................................................................................................................................

00

(26)

13.

Net long-term capital gain (or loss) on sale of your principal residence and/or sole proprietorship business .............................................................

00

(27)

14.

Distributable share on net long-term capital gain (or loss) from Estates or Trusts .................................................................................................

00

(28)

15.

Distributable share on net long-term capital gain (or loss) from Special Partnerships ............................................................................................

00

(29)

16.

Distributable share on net long-term capital gain (or loss) from Corporations of Individuals ....................................................................................

00

(30)

17.

Distributable share on net long-term capital gain (or loss) from Employees - Owned Special Corporations .............................................................

00

(31)

18.

Net long-term capital gain (or loss) attributable to direct investment an not through a Capital Investment Fund (Submit detail) ....................................

00

(32)

19.

Excess of deductions over the income derived from an activity that is not your principal industry or business (See instructions) .......................................

00

(33)

20.

Net long-term capital gain (or loss) (Add lines 12 through 19) ...................................................................................................................

Part III

Long-Term Capital Assets Gains and Losses (Held more than 6 months) Realized under Special Legislation

Fill in if you

(A)

(B)

(C)

(D)

(E)

(F)

Description and Location of Property

Prepaid

Date Acquired

Date Sold

Sale Price

Adjusted Basis

Selling Expenses

Gain or Loss

00

00

00

00

(34)

21.

Net long-term capital gain (or loss) under Act: ________________________ (Decree No. ______________________) .................

(35)

00

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2