Form Fit-20 - Indiana Financial Institution Tax Return - 2003

ADVERTISEMENT

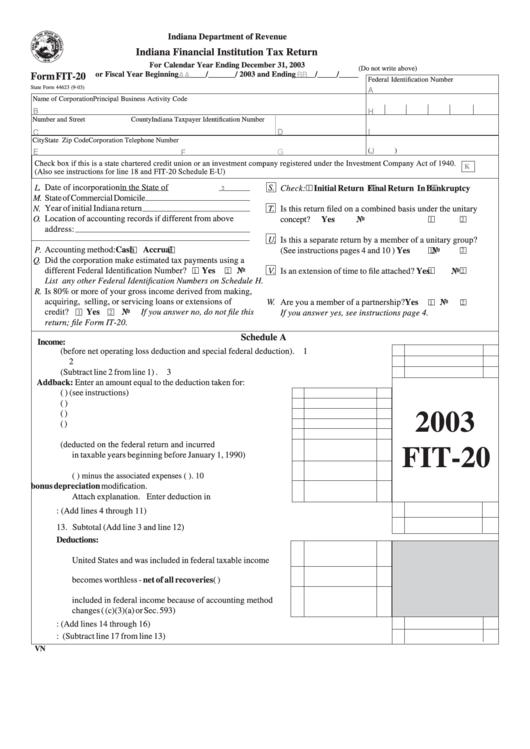

Indiana Department of Revenue

Indiana Financial Institution Tax Return

For Calendar Year Ending December 31, 2003

(Do not write above)

or Fiscal Year Beginning_______/_______/ 2003 and Ending_____/_____/_____

BB

Form FIT-20

AA

Federal Identification Number

State Form 44623 (9-03)

A

Name of Corporation

Principal Business Activity Code

B

H

Number and Street

County

Indiana Taxpayer Identification Number

D

I

C

City

State

Zip Code

Corporation Telephone Number

J

(

)

E

G

F

Check box if this is a state chartered credit union or an investment company registered under the Investment Company Act of 1940.

K

(Also see instructions for line 18 and FIT-20 Schedule E-U)

Date of incorporation

in the State of

L.

S.

1

Check: Initial Return

Final Return

In Bankruptcy

2

1

2

3

State of Commercial Domicile

M.

Year of initial Indiana return

N.

T.

Is this return filed on a combined basis under the unitary

Location of accounting records if different from above

O.

concept?..........................................................

Yes

No

1

2

address:

U.

Is this a separate return by a member of a unitary group?

Accounting method:

Cash

Accrual

P.

(See instructions pages 4 and 10 ).............

Yes

No

1

2

1

2

Did the corporation make estimated tax payments using a

Q.

different Federal Identification Number?

Yes

No

V.

Is an extension of time to file attached?.....

Yes

No

1

2

1

2

List any other Federal Identification Numbers on Schedule H.

Is 80% or more of your gross income derived from making,

R.

acquiring, selling, or servicing loans or extensions of

W.

Are you a member of a partnership? ..........

Yes

No

1

2

credit?

Yes

No

If you answer no, do not file this

1

If you answer yes, see instructions page 4.

2

return; file Form IT-20.

Schedule A

Income:

1. Federal taxable income (before net operating loss deduction and special federal deduction) . 1

2. Qualifying dividend deduction ................................................................................................ 2

3. Subtotal (Subtract line 2 from line 1) ........................................................................................ 3

Addback: Enter an amount equal to the deduction taken for:

4. Bad debts (I.R.C. Sec. 166) (see instructions) ........................... 4

5. Bad debt reserves for banks (I.R.C. Sec. 585) ............................ 5

6. Bad debt reserves (I.R.C. Sec. 593) ............................................ 6

2003

7. Charitable contributions (I.R.C. Sec. 170) .................................. 7

8. All state and local income taxes ................................................ 8

9. Net capital losses (deducted on the federal return and incurred

FIT-20

in taxable years beginning before January 1, 1990) ................... 9

10. Amount of interest excluded for state and local obligations

(I.R.C. Sec. 103) minus the associated expenses (I.R.C. Sec. 265). 10

11. Other income adjustments and bonus depreciation modification.

Attach explanation. Enter deduction in <brackets> ................ 11

12. Total Addbacks: (Add lines 4 through 11) ..............................................................................

12

13. Subtotal (Add line 3 and line 12) .............................................................................................

13

Deductions:

14. Subtract income that is derived from sources outside the

United States and was included in federal taxable income ........ 14

15. Subtract an amount equal to a debt or portion of a debt that

becomes worthless - net of all recoveries (I.R.C. Sec. 166) ....... 15

16. Subtract an amount equal to any bad debt reserves that are

included in federal income because of accounting method

changes (I.R.C. Sec. 585(c)(3)(a) or Sec. 593) ............................ 16

17. Total Deductions: (Add lines 14 through 16) ..........................................................................

17

18. Total Income Prior to Apportionment: (Subtract line 17 from line 13) ...................................

18

VN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5