Form R - Income Tax Return - City Of Akron, Ohio

ADVERTISEMENT

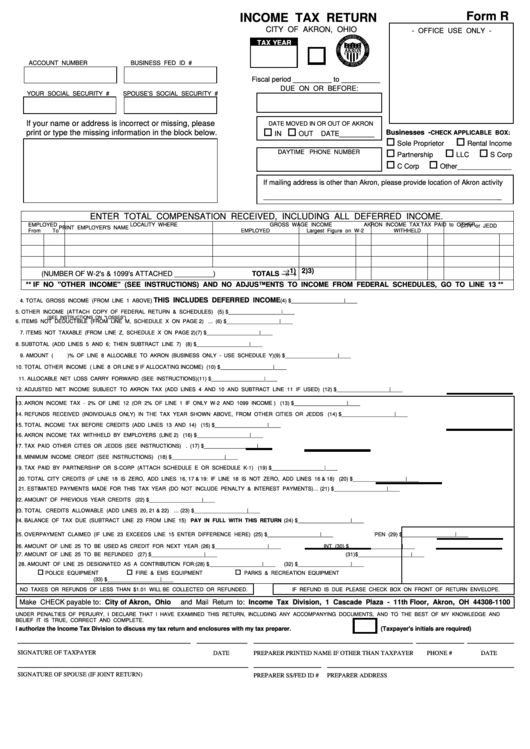

Form R

INCOME TAX RETURN

CITY OF AKRON, OHIO

- OFFICE USE ONLY -

TAX YEAR

ACCOUNT NUMBER

BUSINESS FED ID #

Fiscal period __________ to __________

DUE ON OR BEFORE:

YOUR SOCIAL SECURITY #

SPOUSE’S SOCIAL SECURITY #

If your name or address is incorrect or missing, please

DATE MOVED IN OR OUT OF AKRON

!

!

print or type the missing information in the block below.

Businesses -

CHECK APPLICABLE BOX:

IN

OUT

DATE_________

!

!

Sole Proprietor

Rental Income

!

!

!

DAYTIME PHONE NUMBER

Partnership

LLC

S Corp

!

!

C Corp

Other______________

If mailing address is other than Akron, please provide location of Akron activity

______________________________________________________________

ENTER TOTAL COMPENSATION RECEIVED, INCLUDING ALL DEFERRED INCOME.

EMPLOYED

LOCALITY WHERE

GROSS WAGE INCOME

AKRON INCOME TAX

TAX PAID to OTHER

PRINT EMPLOYER'S NAME

From

To

EMPLOYED

Largest Figure on W-2

WITHHELD

CITY or JEDD

TOTALS → → → →

(NUMBER OF W-2's & 1099's ATTACHED __________)

1)

2)

3)

** IF NO "OTHER INCOME" (SEE INSTRUCTIONS) AND NO ADJUSTMENTS TO INCOME FROM FEDERAL SCHEDULES, GO TO LINE 13 **

THIS INCLUDES DEFERRED INCOME

4. TOTAL GROSS INCOME (FROM LINE 1 ABOVE) ..............................................

......................................................... (4) $__________________|____

5. OTHER INCOME (ATTACH COPY OF FEDERAL RETURN & SCHEDULES) ................................................... (5) $__________________|____

(SEE INSTRUCTIONS ON "LOSSES")

6. ITEMS NOT DEDUCTIBLE (FROM LINE M, SCHEDULE X ON PAGE 2) ......................................................... (6) $__________________|____

7. ITEMS NOT TAXABLE (FROM LINE Z, SCHEDULE X ON PAGE 2) ................................................................. (7) $__________________|____

8. SUBTOTAL (ADD LINES 5 AND 6; THEN SUBTRACT LINE 7) ......................................................................................................................... (8) $__________________|____

9. AMOUNT (

)% OF LINE 8 ALLOCABLE TO AKRON (BUSINESS ONLY - USE SCHEDULE Y) .......................................................... (9) $__________________|____

10. TOTAL OTHER INCOME ( LINE 8 OR LINE 9 IF ALLOCATING INCOME) ............................................................................................................................................................ (10) $__________________|____

11. ALLOCABLE NET LOSS CARRY FORWARD (SEE INSTRUCTIONS) ................................................................................................................................................................ (11) $__________________|____

12. ADJUSTED NET INCOME SUBJECT TO AKRON TAX (ADD LINES 4 AND 10 AND SUBTRACT LINE 11 IF USED) ............................................................................. (12) $__________________|____

13. AKRON INCOME TAX - 2% OF LINE 12 (OR 2% OF LINE 1 IF ONLY W-2 AND 1099 INCOME ) ........................................................ (13) $__________________|____

14. REFUNDS RECEIVED (INDIVIDUALS ONLY) IN THE TAX YEAR SHOWN ABOVE, FROM OTHER CITIES OR JEDDS ....................... (14) $__________________|____

15. TOTAL INCOME TAX BEFORE CREDITS (ADD LINES 13 AND 14) ................................................................................................................................................................ (15) $__________________|____

16. AKRON INCOME TAX WITHHELD BY EMPLOYERS (LINE 2) .......................................................................... (16) $__________________|____

17. TAX PAID OTHER CITIES OR JEDDS (SEE INSTRUCTIONS) ............................................________............ (17) $__________________|____

18. MINIMUM INCOME CREDIT (SEE INSTRUCTIONS) ........................................................................................... (18) $__________________|____

19. TAX PAID BY PARTNERSHIP OR S-CORP (ATTACH SCHEDULE E OR SCHEDULE K-1) ....................... (19) $__________________|____

20. TOTAL CITY CREDITS (IF LINE 18 IS ZERO, ADD LINES 16, 17 & 19: IF LINE 18 IS NOT ZERO, ADD LINES 16 & 18) .................. (20) $__________________|____

21. ESTIMATED PAYMENTS MADE FOR THIS TAX YEAR (DO NOT INCLUDE PENALTY & INTEREST PAYMENTS) ........................…...... (21) $__________________|____

22. AMOUNT OF PREVIOUS YEAR CREDITS ............................................................................................................................................................ (22) $__________________|____

23. TOTAL CREDITS ALLOWABLE (ADD LINES 20, 21 & 22) ............................................................................................................................................…................................... (23) $__________________|____

24. BALANCE OF TAX DUE (SUBTRACT LINE 23 FROM LINE 15) ........................ PAY IN FULL WITH THIS RETURN ........................................................................... (24) $__________________|____

25. OVERPAYMENT CLAIMED (IF LINE 23 EXCEEDS LINE 15 ENTER DIFFERENCE HERE) ......................... (25) $__________________|____

PEN (29) $__________________|____

26. AMOUNT OF LINE 25 TO BE USED AS CREDIT FOR NEXT YEAR .............................................................. (26) $__________________|____

INT (30) $__________________|____

27. AMOUNT OF LINE 25 TO BE REFUNDED .................................................. (27) $__________________|____

(31) $__________________|____

28. AMOUNT OF LINE 25 DESIGNATED AS A CONTRIBUTION FOR: ................................................................. (28) $__________________|____

(32) $__________________|____

!

!

!

POLICE EQUIPMENT

FIRE & EMS EQUIPMENT

PARKS & RECREATION EQUIPMENT

(33) $__________________|____

NO TAXES OR REFUNDS OF LESS THAN $1.01 WILL BE COLLECTED OR REFUNDED.

IF REFUND IS DUE PLEASE CHECK BOX ON FRONT OF RETURN ENVELOPE.

Make CHECK payable to: City of Akron, Ohio

and Mail Return to: Income Tax Division, 1 Cascade Plaza - 11th Floor, Akron, OH 44308-1100

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ANY ACCOMPANYING DOCUMENTS, AND TO THE BEST OF MY KNOWLEDGE AND

BELIEF IT IS TRUE, CORRECT AND COMPLETE.

I authorize the Income Tax Division to discuss my tax return and enclosures with my tax preparer.

(Taxpayer's initials are required)

_______________________________________________________

________________________

_______________________________________

__________________

____________

SIGNATURE OF TAXPAYER

DATE

PREPARER PRINTED NAME IF OTHER THAN TAXPAYER

PHONE #

DATE

_______________________________________________________

_____________________

_______________________________________

SIGNATURE OF SPOUSE (IF JOINT RETURN)

PREPARER SS/FED ID #

PREPARER ADDRESS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2