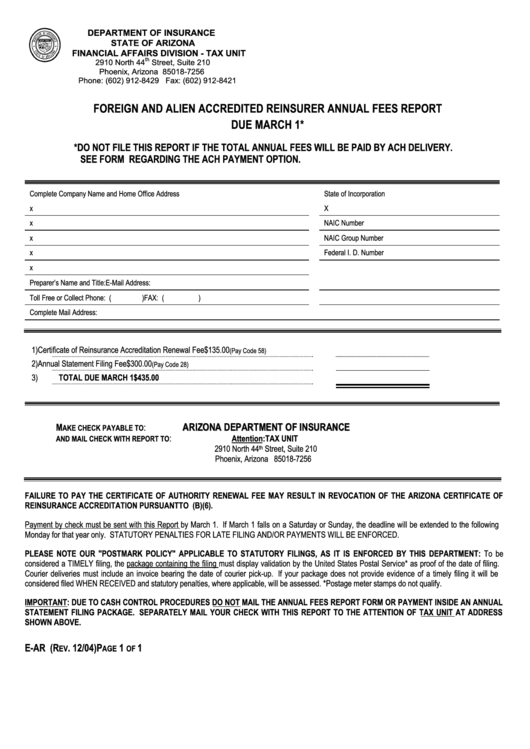

DEPARTMENT OF INSURANCE

STATE OF ARIZONA

FINANCIAL AFFAIRS DIVISION - TAX UNIT

th

2910 North 44

Street, Suite 210

Phoenix, Arizona 85018-7256

Phone: (602) 912-8429 Fax: (602) 912-8421

FOREIGN AND ALIEN ACCREDITED REINSURER ANNUAL FEES REPORT

DUE MARCH 1*

*DO NOT FILE THIS REPORT IF THE TOTAL ANNUAL FEES WILL BE PAID BY ACH DELIVERY.

SEE FORM E-ACH.INSTRUCTION FOR DETAILS REGARDING THE ACH PAYMENT OPTION.

Complete Company Name and Home Office Address

State of Incorporation

x

X

x

NAIC Number

x

NAIC Group Number

x

Federal I. D. Number

x

Preparer’s Name and Title:

E-Mail Address:

Toll Free or Collect Phone: (

)

FAX: (

)

Complete Mail Address:

1)

Certificate of Reinsurance Accreditation Renewal Fee

$

135.00

(Pay Code 58)

2)

Annual Statement Filing Fee

$

300.00

(Pay Code 28)

3)

TOTAL DUE MARCH 1

$

435.00

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

A

R

I

Z

O

N

A

D

E

P

A

R

T

M

E

N

T

O

F

I

N

S

U

R

A

N

C

E

M

:

AKE CHECK PAYABLE TO

:

Attention: TAX UNIT

AND MAIL CHECK WITH REPORT TO

2910 North 44

Street, Suite 210

th

Phoenix, Arizona 85018-7256

FAILURE TO PAY THE CERTIFICATE OF AUTHORITY RENEWAL FEE MAY RESULT IN REVOCATION OF THE ARIZONA CERTIFICATE OF

REINSURANCE ACCREDITATION PURSUANT TO A.A.C. R20-6-1601(B)(6).

Payment by check must be sent with this Report by March 1. If March 1 falls on a Saturday or Sunday, the deadline will be extended to the following

Monday for that year only. STATUTORY PENALTIES FOR LATE FILING AND/OR PAYMENTS WILL BE ENFORCED.

PLEASE NOTE OUR "POSTMARK POLICY" APPLICABLE TO STATUTORY FILINGS, AS IT IS ENFORCED BY THIS DEPARTMENT: To be

considered a TIMELY filing, the package containing the filing must display validation by the United States Postal Service* as proof of the date of filing.

Courier deliveries must include an invoice bearing the date of courier pick-up. If your package does not provide evidence of a timely filing it will be

considered filed WHEN RECEIVED and statutory penalties, where applicable, will be assessed. *Postage meter stamps do not qualify.

IMPORTANT: DUE TO CASH CONTROL PROCEDURES DO NOT MAIL THE ANNUAL FEES REPORT FORM OR PAYMENT INSIDE AN ANNUAL

STATEMENT FILING PACKAGE. SEPARATELY MAIL YOUR CHECK WITH THIS REPORT TO THE ATTENTION OF TAX UNIT AT ADDRESS

SHOWN ABOVE.

E-AR (R

. 12/04)

P

1

1

EV

AGE

OF

1

1