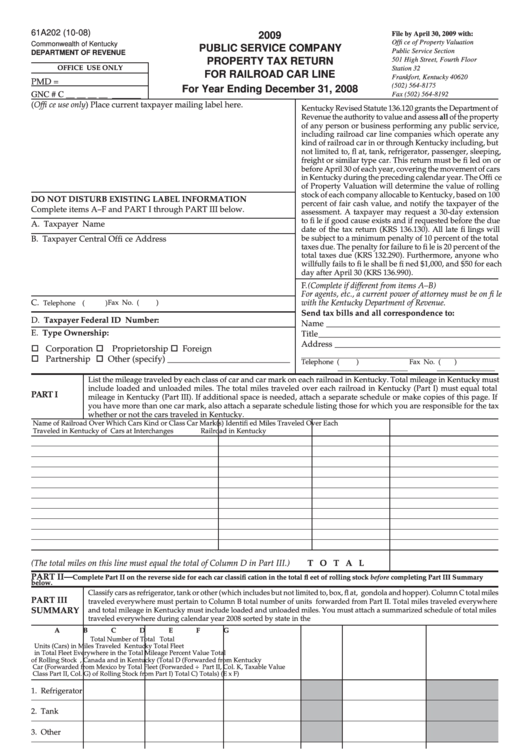

Form 61a202 - Public Service Company Property Tax Return For Railroad Car Line - 2009

ADVERTISEMENT

61A202 (10-08)

2009

File by April 30, 2009 with:

Offi ce of Property Valuation

Commonwealth of Kentucky

PUBLIC SERVICE COMPANY

Public Service Section

DEPARTMENT OF REVENUE

501 High Street, Fourth Floor

PROPERTY TAX RETURN

OFFICE USE ONLY

Station 32

FOR RAILROAD CAR LINE

Frankfort, Kentucky 40620

PMD =

(502) 564-8175

For Year Ending December 31, 2008

GNC # C __ __ __ __ ______

Fax (502) 564-8192

(Offi ce use only) Place current taxpayer mailing label here.

Kentucky Revised Statute 136.120 grants the Department of

Revenue the authority to value and assess all of the property

of any person or business performing any public service,

including railroad car line companies which operate any

kind of railroad car in or through Kentucky including, but

not limited to, fl at, tank, refrigerator, passenger, sleeping,

freight or similar type car. This return must be fi led on or

before April 30 of each year, covering the movement of cars

in Kentucky during the preceding calendar year. The Offi ce

of Property Valuation will determine the value of rolling

stock of each company allocable to Kentucky, based on 100

DO NOT DISTURB EXISTING LABEL INFORMATION

percent of fair cash value, and notify the taxpayer of the

Complete items A–F and PART I through PART III below.

assessment. A taxpayer may request a 30-day extension

to fi le if good cause exists and if requested before the due

A. Taxpayer Name

date of the tax return (KRS 136.130). All late fi lings will

be subject to a minimum penalty of 10 percent of the total

B. Taxpayer Central Offi ce Address

taxes due. The penalty for failure to fi le is 20 percent of the

total taxes due (KRS 132.290). Furthermore, anyone who

willfully fails to fi le shall be fi ned $1,000, and $50 for each

day after April 30 (KRS 136.990).

F. (Complete if different from items A–B)

For agents, etc., a current power of attorney must be on fi le

C.

with the Kentucky Department of Revenue.

Fax No. (

)

Telephone (

)

Send tax bills and all correspondence to:

D. Taxpayer Federal ID Number:

Name __________________________________________

E. Type Ownership:

Title ____________________________________________

Address ________________________________________

Corporation

Proprietorship

Foreign

________________________________________________

Partnership

Other (specify) ____________________________

Telephone (

)

Fax No. (

)

List the mileage traveled by each class of car and car mark on each railroad in Kentucky. Total mileage in Kentucky must

include loaded and unloaded miles. The total miles traveled over each railroad in Kentucky (Part I) must equal total

PART I

mileage in Kentucky (Part III). If additional space is needed, attach a separate schedule or make copies of this page. If

you have more than one car mark, also attach a separate schedule listing those for which you are responsible for the tax

whether or not the cars traveled in Kentucky.

Name of Railroad Over Which Cars

Kind or Class

Car Mark(s) Identifi ed

Miles Traveled Over Each

Traveled in Kentucky

of Cars

at Interchanges

Railroad in Kentucky

(The total miles on this line must equal the total of Column D in Part III.)

TOTAL

PART II—

Complete Part II on the reverse side for each car classifi cation in the total fl eet of rolling stock before completing Part III Summary

below.

Classify cars as refrigerator, tank or other (which includes but not limited to, box, fl at, gondola and hopper). Column C total miles

PART III

traveled everywhere must pertain to Column B total number of units forwarded from Part II. Total miles traveled everywhere

SUMMARY

and total mileage in Kentucky must include loaded and unloaded miles. You must attach a summarized schedule of total miles

traveled everywhere during calendar year 2008 sorted by state in the U.S. and include Canada and Mexico.

A

B

C

D

E

F

G

Total Number of

Total

Total

Units (Cars) in

Miles Traveled

Kentucky

Total Fleet

in Total Fleet

Everywhere in the

Total Mileage

Percent

Value

Total

of Rolling Stock

U.S., Canada and

in Kentucky

(Total D

(Forwarded from

Kentucky

Car

(Forwarded from

Mexico by Total Fleet

(Forwarded

÷

Part II, Col. K,

Taxable Value

Class

Part II, Col. G)

of Rolling Stock

from Part I)

Total C)

Totals)

(E x F)

1. Refrigerator

2. Tank

3. Other

TOTALS

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) has been examined by

me and to the best of my knowledge and belief is a true, correct and complete return.

Printed Name

Printed Title

Signature

Title

Date

(Note: For agents, etc., a current power of attorney must be on fi le with the Kentucky Department of Revenue.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2