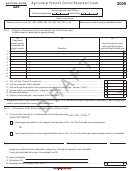

Arizona Form 325 - Agricultural Pollution Control Equipment Credit - 2004 Page 2

ADVERTISEMENT

AZ Form 325 (2004) Page 2

Part III

Partner’s Share of Credit

Complete lines 21 through 23 separately for each partner. Furnish each partner with a copy of the completed Form 325.

21 Name of partner

22 Partner’s TIN

23 Partner’s share of the amount on Part I, line 16

Part IV Available Credit Carryover

(a)

(b)

(c)

(d)

Carryover

Original credit

Amount

Avaliable carryover -

credit from

amount

previously used

Subtract column (c)

taxable year ending

from column (b)

24

25

26

27

28

Total available carryover

29

Part V

Total Available Credit

30 Current year’s credit. Individuals, corporations, or S corporations - enter amount from Part I, line 16.

S corporation shareholders - enter the amount from Part II, line 20.

Partners of a partnership - enter amount from Part III, line 23 ........................................................................................................

30

00

31 Available credit carryover - from Part IV, line 29, column (d)...........................................................................................................

31

00

32 Total available credit. Add line 30 and line 31. Enter total here and on Form 300, Part I, line 15 or Form 301, Part I, line 19........

32

00

ADOR 91-0017 (04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2