Form W1 1108 - Employer'S Withholding - Quarterly - 2017 - City Of Washington Court House

ADVERTISEMENT

00001

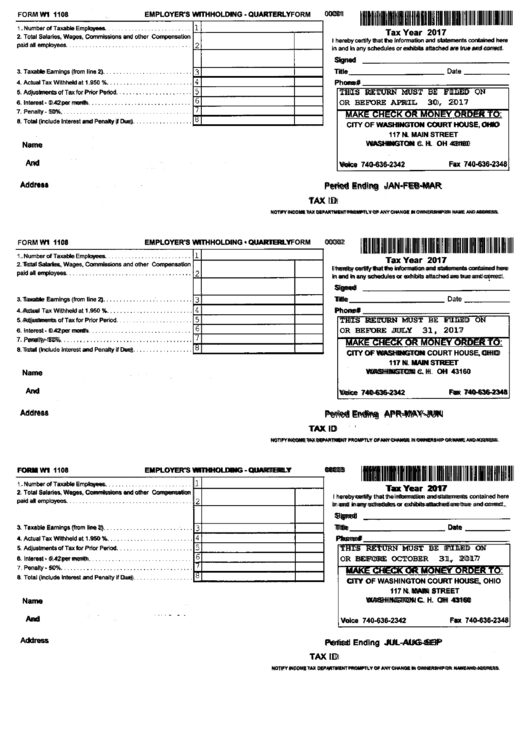

FORM W1 1108

EMPLOYER'S WITHHOLDING - QUARTERLY

1111111111111111111111111111111

.Number of Taxable Employees.

Tax Year 2017

2. Total Salaries, Wages, Commissions and other Compensation

hereby certify that the information and statements contained here

paid all employees.

in and in any schedules or exhibits attached are true and correct.

Signed

Title

3. Taxable Earnings (from line 2).

Phone#

4. Actual Tax Withheld at 1.950 %.

FILED

THIS

RETURN MUST

5. Adjustments of Tax for Prior Period.

2이 フ

BEFORE APRIL

30,

6. Interest - 0.42 per month.

:

7. Penalty - 50%,

MAKE CHECK OR MONEY ORDER TO

8. Total (include Interest and Penalty ¡f Due).

CITY OF WASHINGTON COURT HOUSE, OHIO

117 N. MAIN STREET

WASHINGTON

c.

H. OH

43160

Name

And

Fax 740-636-2348

Voice 740-636-2342

Address

Period Ending JAN-FEB-MAR

TAX เอ

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS.

00002

FORM W1 1108

EMPLOYER'S WITHHOLDING • QUARTERLY

.Number of Taxable Employees.

Tax Year 2017

2. Total Salaries, Wages, Commissions and other Compensation

I hereby certify that the information and statements contained here

paid all employees.

in and in any schedules or exhibits attached are true and correct.

Signed

Title

3. Taxable Earnings (from line 2).

Phone#

4. Actual Tax Withheld at 1.950 %.

FILED ON

THIS

RETURN MUST

5. Adjustments of Tax for Prior Period.

2017

BEFORE JULY

31,

6. Interest - 0.42 per month.

:

7. Penalty-50%.

MAKE CHECK OR MONEY ORDER TO

8. Total (Include Interest and Penalty if Due).

CITY OF WASHINGTON COURT HOUSE, OHIO

117 N. MAIN STREET

WASHINGTON

H.

OH 43160

c.

Name

And

Voice 740-636-2342

Fax 740-636-2348

Address

Period Ending APR-MAY-JUN

TAX ID

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS.

1111111111111111111111เท

00003

FORM W1 1108

EMPLOYER'S WITHHOLDING - QUARTERLY

.Number of Taxable Employees.

Tax Year 2017

2. Total Salaries, Wages, Commissions and other Compensation

I hereby certify that the information and statements contained here

paid all employees.

in and in any schedules or exhibits attached are true and correct.,

Signed

Date

Title

3. Taxable Earnings (from line 2).

Phone#

4. Actual Tax Withheld at 1.950 %.

MUST

FILED ON

THIS

RETURN

5. Adjustments of Tax for Prior Period.

2017

BEFORE

OCTOBER

31,

6. Interest - 0.42 per month,

:

Penalty - 50%.

MAKE CHECK OR MONEY ORDER TO

8. Total (Include Interest and Penalty if Due).

CITY OF WASHINGTON COURT HOUSE, OHIO

117 N. MAIN STREET

WASHINGTON C. H. OH 43160

Name

And

Fax 740-636-2348

Voice 740-636-2342

Address

Period Ending JUL-AUG-SEP

TAX เอ

NOTIFY INCOME TAX DEPARTMENT PROMPTLY OF ANY CHANGE IN OWNERSHIP OR NAME AND ADDRESS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2