Form Sc 1040 - South Carolina Individual Income Tax Return - 2003 Page 2

ADVERTISEMENT

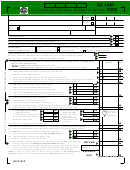

Resident filers complete lines 35 through 60.

STOP!

Nonresident filers complete Schedule NR. Do not complete lines 35 through 60.

Dollars

Cents

35 Enter amount from line 1.

00

35

PART 1

ADDITIONS TO FEDERAL TAXABLE INCOME

00

36 Married filers claiming standard deduction. (See instructions)

36

37 If itemizing your state and local income tax deduction, enter the amount from

00

line 5 of Worksheet A (See instructions)

37

00

38 Out-of-state losses - (See instructions)

38

00

39 Expenses related to National Guard and Military Reserve income.

39

40 Interest income on obligations of states and political subdivisions

00

other than South Carolina .

40

00

41 Other additions to income. Attach an explanation (See instructions)

41

00

42 TOTAL ADDITIONS ---- add lines 36 through 41 and enter your total additions to income here.

42

00

43 Add line 35 and line 42 and enter total here.

43

PART 2

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME

00

44 State tax refund, if included on line 10, on your federal Form 1040.

44

00

45 Interest income from obligations of the US government.

45

00

46 National Guard or Reserve annual training and drill pay. (See instructions)

46

00

47 Permanent disability retirement income, if taxed on your federal return.

47

00

48 Social Security and/or railroad retirement, if taxed on your federal return.

48

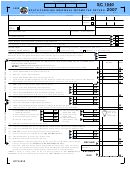

49 Caution: Retirement Deduction - (See instructions)

00

a) Taxpayer: Date of Birth

____________

49a

00

b) Spouse: Date of Birth ____________

49b

00

c) Surviving Spouse: Date of Birth of Deceased Spouse ____________

49c

50 Age 65 and older deduction - (See instructions)

00

a) Taxpayer: Date of Birth _____________

50a

00

b) Spouse:

Date of Birth _____________

50b

00

51 Out-of-state income/gain -

51

Do not include personal service income.

(See instructions.)

00

52 Negative amount of federal taxable income.

52

53 44% of net capital gains held for more than one year (See instructions)

00

53

00

54 Subsistence Allowance ______________ days @ $6.67

54

00

55 Volunteer Firefighters/Rescue Squad/HAZ-MAT Deduction. (See instructions)

55

56 Dependents under the age of 6 years on December 31, 2003.

Date of Birth ________________ SSN __________________________

00

___

56

Date of Birth ________________ SSN _______________________

57 Contributions to the SC Tuition Prepayment Program or College Investment

Program. (See instructions)

00

57

00

58 Other subtractions. (See instructions) ____________________

58

00

59 TOTAL SUBTRACTIONS ---- add lines 44 through 58 and enter the total.

59

60 South Carolina INCOME SUBJECT TO TAX Subtract line 59 from line 43.

Enter here and on line 2 of this return. If less than zero, enter zero.

00

60

I declare that this return and all attachments are true, correct and complete to the best of my knowledge and belief.

Your Signature

Date

Spouse's Signature (if jointly, BOTH must sign)

I authorize the Director of the Department of Revenue or delegate to

Preparer's Printed Name

Yes

No

discuss this return, attachments and related tax matters with the preparer.

If prepared by a person other than taxpayer, his declaration is based on all information of which he has any knowledge.

Paid

Preparer's

Prepared by

Date

Address

Use Only

EI Number

Phone Number

City

State

Zip

ATTACH A COMPLETE COPY OF YOUR FEDERAL RETURN ONLY IF you have income and/or (loss) on federal Schedules C, D, E, F or filed a SC

Schedule NR, SC1040TC or I-319.

MAIL RETURN TO THE PROPER ADDRESS:

REFUNDS OR ZERO TAX: SC1040 PROCESSING CENTER, P.O. BOX 101100, COLUMBIA SC 29211-0100

BALANCE DUES:

TAXABLE PROCESSING CENTER, P.O. BOX 101105, COLUMBIA SC 29211-0105

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2