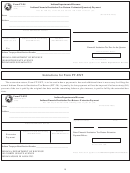

IA 706, page 2

15. Marital status of decedent at death: Married ☐

Widow(er) ☐

Single ☐

Divorced ☐

The relationship of decedent’s children to surviving spouse must be included if decedent died intestate.

16. Were any children born to or adopted by the decedent after execution of the last will? ............................................. Yes ☐

No ☐

In all cases of adoption, include a copy of the decree.

17. Decedent’s occupation before death

18. Decedent died: Intestate (include heirship chart) ..... ☐

Estate has trust (include trust agreement) .........☐

Testate (include copy of will) ........... ☐

19. Election of spouse. Submit copy of election: Under will ☐

Distributive share ☐

20. Was a disclaimer filed? If yes, submit copy of disclaimer ........................................................................................... Yes ☐

No ☐

21. Do you elect the special use valuation? ..................................................................................................................... Yes ☐

No ☐

22. Was a federal estate tax return filed? If yes, submit copy .......................................................................................... Yes ☐

No ☐

23. Do you elect to claim qualified terminal interest property (QTIP) under Iowa Code 450.3(7) and

IRC section 2056(b)(7)(B)? If yes, include copy of Schedule M of federal estate tax return ...................................... Yes ☐

No ☐

24. Do you elect to pay the federal estate tax in installments as described in IRC section 6166? ................................... Yes ☐

No ☐

25. Do you elect the alternate valuations under Iowa Code section 450.37 (IRC section 2032)? .................................... Yes ☐

No ☐

Summary of Gross Estate

Alternate

Value at Date

Include applicable schedules only. Federal schedules may be used in place of Iowa schedules.

Value

of Death

26. Real Estate, from Schedule A. ......................................................................................... 26.

27. Stocks and Bonds, from Schedule B. ............................................................................... 27.

28. Mortgages, Notes, and Cash, from Schedule C. .............................................................. 28.

29. Insurance on Decedent’s Life, from Schedule D. Include federal form(s) 712. ................. 29.

30. Jointly Owned Property, from Schedule E. ....................................................................... 30.

31. Other Miscellaneous Property, from Schedule F. ............................................................. 31.

32. Transfers During Decedent’s Life, from Schedule G. ....................................................... 32.

33. Powers of Appointment, from Schedule H. ....................................................................... 33.

34. Annuities, Section 529 plans, and ABLE plans from Schedule I. ...................................... 34.

35. Total Gross Estate. Add items 26 through 34. Must equal line 3, page 1. ........................ 35.

Summary of Deductions – Include Schedules J and K.

36. Funeral and Administrative expenses, from Schedule J. ........................................................................... 36.

37. Debts of Decedent, from Schedule K, part I. ............................................................................................. 37.

38. Mortgages and Liens, from Schedule K, part II. ........................................................................................ 38.

39. Total Deductions. Add lines 36 through 38. Enter here and on page 1, line 4. .......................................... 39.

Summary of Real and Personal Property Located Outside of Iowa not included in Lines 26-34 (Required)

Item Description

Real

Personal

$

$

Total. Add all real and personal property items listed above. .............................................................................. $

60-008b (06/22/16)

1

1 2

2