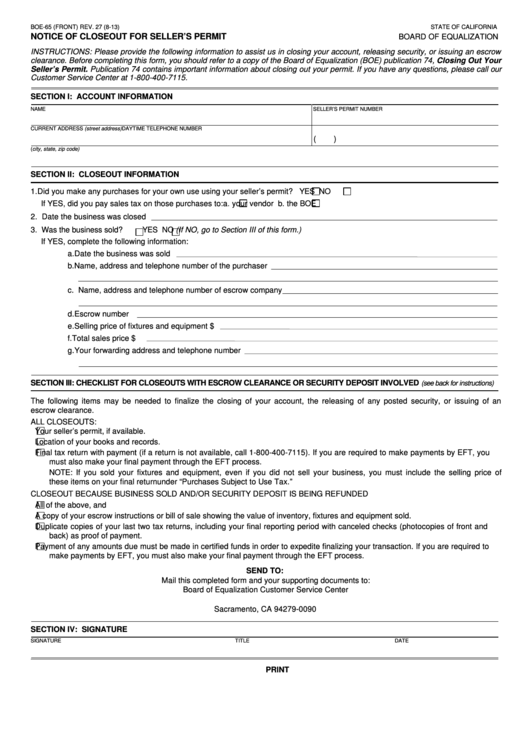

BOE-65 (FRONT) REV. 27 (8-13)

STATE OF CALIFORNIA

NOTICE OF CLOSEOUT FOR SELLER’S PERMIT

BOARD OF EQUALIZATION

INSTRUCTIONS: Please provide the following information to assist us in closing your account, releasing security, or issuing an escrow

clearance. Before completing this form, you should refer to a copy of the Board of Equalization (BOE) publication 74, Closing Out Your

Seller’s Permit. Publication 74 contains important information about closing out your permit. If you have any questions, please call our

Customer Service Center at 1-800-400-7115.

SECTION I: ACCOUNT INFORMATION

NAME

SELLER’S PERMIT NUMBER

CURRENT ADDRESS (street address)

DAYTIME TELEPHONE NUMBER

(

)

(city, state, zip code)

SECTION II: CLOSEOUT INFORMATION

1. Did you make any purchases for your own use using your seller’s permit?

YES

NO

If YES, did you pay sales tax on those purchases to:

a. your vendor

b. the BOE

2. Date the business was closed

3. Was the business sold?

YES

NO (If NO, go to Section III of this form.)

If YES, complete the following information:

a. Date the business was sold

b. Name, address and telephone number of the purchaser

c. Name, address and telephone number of escrow company

d. Escrow number

e. Selling price of fixtures and equipment $

f. Total sales price $

g. Your forwarding address and telephone number

SECTION III: CHECKLIST FOR CLOSEOUTS WITH ESCROW CLEARANCE OR SECURITY DEPOSIT INVOLVED

(see back for instructions)

The following items may be needed to finalize the closing of your account, the releasing of any posted security, or issuing of an

escrow clearance.

ALL CLOSEOUTS:

Your seller’s permit, if available.

Location of your books and records.

Final tax return with payment (if a return is not available, call 1-800-400-7115). If you are required to make payments by EFT, you

must also make your final payment through the EFT process.

NOTE: If you sold your fixtures and equipment, even if you did not sell your business, you must include the selling price of

these items on your final return under “Purchases Subject to Use Tax.”

CLOSEOUT BECAUSE BUSINESS SOLD AND/OR SECURITY DEPOSIT IS BEING REFUNDED

All of the above, and

A copy of your escrow instructions or bill of sale showing the value of inventory, fixtures and equipment sold.

Duplicate copies of your last two tax returns, including your final reporting period with canceled checks (photocopies of front and

back) as proof of payment.

Payment of any amounts due must be made in certified funds in order to expedite finalizing your transaction. If you are required to

make payments by EFT, you must also make your final payment through the EFT process.

SEND TO:

Mail this completed form and your supporting documents to:

Board of Equalization Customer Service Center

P.O. Box 942879

Sacramento, CA 94279-0090

SECTION IV: SIGNATURE

SIGNATURE

TITLE

DATE

CLEAR

PRINT

1

1 2

2