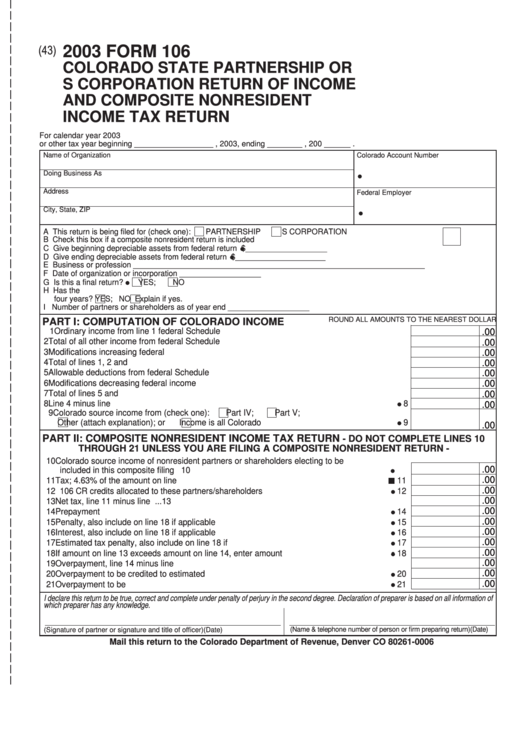

2003 FORM 106

(43)

COLORADO STATE PARTNERSHIP OR

S CORPORATION RETURN OF INCOME

AND COMPOSITE NONRESIDENT

INCOME TAX RETURN

For calendar year 2003

or other tax year beginning __________________ , 2003, ending ________ , 200 ______ .

Name of Organization

Colorado Account Number

Doing Business As

Address

Federal Employer I.D. Number

City, State, ZIP

A This return is being filed for (check one):

PARTNERSHIP

S CORPORATION

B Check this box if a composite nonresident return is included .....................................................................................

C Give beginning depreciable assets from federal return

$___________________

D Give ending depreciable assets from federal return

$_____________________

E Business or profession ____________________________________________________________________

F Date of organization or incorporation ___________________

G Is this a final return?

YES;

NO

H Has the I.R.S. made any adjustments to your federal return or have you filed amended federal returns during the last

four years?

YES;

NO Explain if yes.

I Number of partners or shareholders as of year end ___________________

ROUND ALL AMOUNTS TO THE NEAREST DOLLAR

PART I: COMPUTATION OF COLORADO INCOME

1 Ordinary income from line 1 federal Schedule K ........................................................................ 1

.00

2 Total of all other income from federal Schedule K ..................................................................... 2

.00

3 Modifications increasing federal income ..................................................................................... 3

.00

4 Total of lines 1, 2 and 3 ............................................................................................................... 4

.00

5 Allowable deductions from federal Schedule K ........................................................................... 5

.00

6 Modifications decreasing federal income .................................................................................... 6

.00

7 Total of lines 5 and 6 .................................................................................................................. 7

.00

8 Line 4 minus line 7 ..................................................................................................................

8

.00

9 Colorado source income from (check one):

Part IV;

Part V;

Other (attach explanation); or

Income is all Colorado income ...................................... 9

.00

PART II: COMPOSITE NONRESIDENT INCOME TAX RETURN

- DO NOT COMPLETE LINES 10

THROUGH 21 UNLESS YOU ARE FILING A COMPOSITE NONRESIDENT RETURN -

10 Colorado source income of nonresident partners or shareholders electing to be

.00

included in this composite filing ............................................................................................ 10

.00

11 Tax; 4.63% of the amount on line 10 ...................................................................................... 11

.00

12 106 CR credits allocated to these partners/shareholders ........................................................ 12

.00

13 Net tax, line 11 minus line 12 .................................................................................................. 13

.00

14 Prepayment credits ............................................................................................................... 14

.00

15 Penalty, also include on line 18 if applicable ........................................................................ 15

.00

16 Interest, also include on line 18 if applicable ........................................................................ 16

.00

17 Estimated tax penalty, also include on line 18 if applicable .................................................. 17

.00

18 If amount on line 13 exceeds amount on line 14, enter amount owed ................................. 18

.00

19 Overpayment, line 14 minus line 13 ........................................................................................ 19

.00

20 Overpayment to be credited to estimated tax ....................................................................... 20

.00

21 Overpayment to be refunded ................................................................................................ 21

I declare this return to be true, correct and complete under penalty of perjury in the second degree. Declaration of preparer is based on all information of

which preparer has any knowledge.

(Name & telephone number of person or firm preparing return)

(Date)

(Signature of partner or signature and title of officer)

(Date)

Mail this return to the Colorado Department of Revenue, Denver CO 80261-0006

1

1