Form Ct-2na - Connecticut Nonresident Income Tax Agreement/ Election To Be Included In A Group Return - Department Of Revenue Services

ADVERTISEMENT

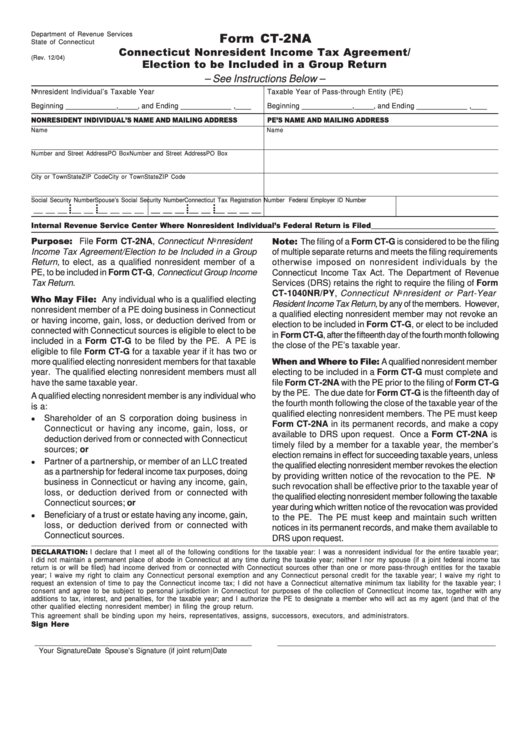

Form CT-2NA

Department of Revenue Services

State of Connecticut

Connecticut Nonresident Income Tax Agreement/

(Rev. 12/04)

Election to be Included in a Group Return

– See Instructions Below –

Nonresident Individual’s Taxable Year

Taxable Year of Pass-through Entity (PE)

Beginning _____________ , _____ , and Ending _____________ , ____

Beginning _____________ , _____ , and Ending _____________ , ____

NONRESIDENT INDIVIDUAL’S NAME AND MAILING ADDRESS

PE’S NAME AND MAILING ADDRESS

Name

Name

Number and Street Address

PO Box

Number and Street Address

PO Box

City or Town

State

ZIP Code

City or Town

State

ZIP Code

Social Security Number

Spouse’s Social Security Number

Connecticut Tax Registration Number

Federal Employer ID Number

• •

• •

• •

• •

__ __ __ __ __ __ __ __ __

__ __ __ __ __ __ __ __ __

• •

• •

• •

• •

Internal Revenue Service Center Where Nonresident Individual’s Federal Return is Filed ___________________________________

Purpose: File Form CT-2NA, Connecticut Nonresident

Note: The filing of a Form CT-G is considered to be the filing

Income Tax Agreement/Election to be Included in a Group

of multiple separate returns and meets the filing requirements

Return, to elect, as a qualified nonresident member of a

otherwise imposed on nonresident individuals by the

PE, to be included in Form CT-G, Connecticut Group Income

Connecticut Income Tax Act. The Department of Revenue

Tax Return.

Services (DRS) retains the right to require the filing of Form

CT-1040NR/PY, Connecticut Nonresident or Part-Year

Who May File: Any individual who is a qualified electing

Resident Income Tax Return, by any of the members. However,

nonresident member of a PE doing business in Connecticut

a qualified electing nonresident member may not revoke an

or having income, gain, loss, or deduction derived from or

election to be included in Form CT-G, or elect to be included

connected with Connecticut sources is eligible to elect to be

in Form CT-G, after the fifteenth day of the fourth month following

included in a Form CT-G to be filed by the PE. A PE is

the close of the PE’s taxable year.

eligible to file Form CT-G for a taxable year if it has two or

When and Where to File: A qualified nonresident member

more qualified electing nonresident members for that taxable

year. The qualified electing nonresident members must all

electing to be included in a Form CT-G must complete and

have the same taxable year.

file Form CT-2NA with the PE prior to the filing of Form CT-G

by the PE. The due date for Form CT-G is the fifteenth day of

A qualified electing nonresident member is any individual who

the fourth month following the close of the taxable year of the

is a:

qualified electing nonresident members. The PE must keep

Shareholder of an S corporation doing business in

Form CT-2NA in its permanent records, and make a copy

Connecticut or having any income, gain, loss, or

available to DRS upon request. Once a Form CT-2NA is

deduction derived from or connected with Connecticut

timely filed by a member for a taxable year, the member’s

sources; or

election remains in effect for succeeding taxable years, unless

Partner of a partnership, or member of an LLC treated

the qualified electing nonresident member revokes the election

as a partnership for federal income tax purposes, doing

by providing written notice of the revocation to the PE. No

business in Connecticut or having any income, gain,

such revocation shall be effective prior to the taxable year of

loss, or deduction derived from or connected with

the qualified electing nonresident member following the taxable

Connecticut sources; or

year during which written notice of the revocation was provided

Beneficiary of a trust or estate having any income, gain,

to the PE. The PE must keep and maintain such written

loss, or deduction derived from or connected with

notices in its permanent records, and make them available to

Connecticut sources.

DRS upon request.

DECLARATION: I declare that I meet all of the following conditions for the taxable year: I was a nonresident individual for the entire taxable year;

I did not maintain a permanent place of abode in Connecticut at any time during the taxable year; neither I nor my spouse (if a joint federal income tax

return is or will be filed) had income derived from or connected with Connecticut sources other than one or more pass-through entities for the taxable

year; I waive my right to claim any Connecticut personal exemption and any Connecticut personal credit for the taxable year; I waive my right to

request an extension of time to pay the Connecticut income tax; I did not have a Connecticut alternative minimum tax liability for the taxable year; I

consent and agree to be subject to personal jurisdiction in Connecticut for purposes of the collection of Connecticut income tax, together with any

additions to tax, interest, and penalties, for the taxable year; and I authorize the PE to designate a member who will act as my agent (and that of the

other qualified electing nonresident member) in filing the group return.

This agreement shall be binding upon my heirs, representatives, assigns, successors, executors, and administrators.

Sign Here

___________________________________________________________

________________________________________________________

Your Signature

Date

Spouse’s Signature (if joint return)

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1