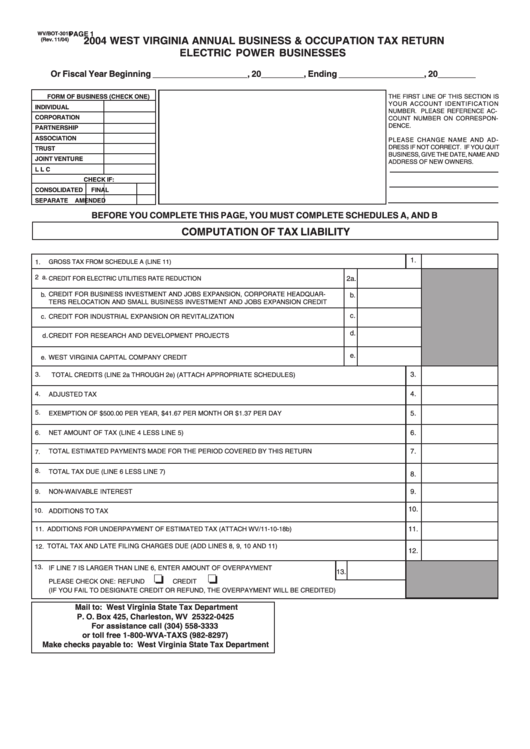

Form Wv/bot-301e - 2004 West Virginia Annual Business & Occupation Tax Return Electric Power Businesses

ADVERTISEMENT

WV/BOT-301E

PAGE 1

2004 WEST VIRGINIA ANNUAL BUSINESS & OCCUPATION TAX RETURN

(Rev. 11/04)

ELECTRIC POWER BUSINESSES

Or Fiscal Year Beginning ____________________, 20_________, Ending __________________, 20________

FORM OF BUSINESS (CHECK ONE)

THE FIRST LINE OF THIS SECTION IS

YOUR ACCOUNT IDENTIFICATION

INDIVIDUAL

NUMBER. PLEASE REFERENCE AC-

CORPORATION

COUNT NUMBER ON CORRESPON-

DENCE.

PARTNERSHIP

ASSOCIATION

PLEASE CHANGE NAME AND AD-

DRESS IF NOT CORRECT. IF YOU QUIT

TRUST

BUSINESS, GIVE THE DATE, NAME AND

JOINT VENTURE

ADDRESS OF NEW OWNERS.

L L C

CHECK IF:

CONSOLIDATED

FINAL

SEPARATE

AMENDED

BEFORE YOU COMPLETE THIS PAGE, YOU MUST COMPLETE SCHEDULES A, AND B

COMPUTATION OF TAX LIABILITY

1.

GROSS TAX FROM SCHEDULE A (LINE 11)

1.

2 a.

CREDIT FOR ELECTRIC UTILITIES RATE REDUCTION

2a.

CREDIT FOR BUSINESS INVESTMENT AND JOBS EXPANSION, CORPORATE HEADQUAR-

b.

b.

TERS RELOCATION AND SMALL BUSINESS INVESTMENT AND JOBS EXPANSION CREDIT

c.

c.

CREDIT FOR INDUSTRIAL EXPANSION OR REVITALIZATION

d.

.

d

CREDIT FOR RESEARCH AND DEVELOPMENT PROJECTS

e.

e.

WEST VIRGINIA CAPITAL COMPANY CREDIT

3.

3.

TOTAL CREDITS (LINE 2a THROUGH 2e) (ATTACH APPROPRIATE SCHEDULES)

4.

ADJUSTED TAX

4.

5.

EXEMPTION OF $500.00 PER YEAR, $41.67 PER MONTH OR $1.37 PER DAY

5.

6.

NET AMOUNT OF TAX (LINE 4 LESS LINE 5)

6.

TOTAL ESTIMATED PAYMENTS MADE FOR THE PERIOD COVERED BY THIS RETURN

7.

7.

8.

TOTAL TAX DUE (LINE 6 LESS LINE 7)

8.

9.

NON-WAIVABLE INTEREST

9.

10.

10.

ADDITIONS TO TAX

11.

ADDITIONS FOR UNDERPAYMENT OF ESTIMATED TAX (ATTACH WV/11-10-18b)

11.

TOTAL TAX AND LATE FILING CHARGES DUE (ADD LINES 8, 9, 10 AND 11)

12.

12.

13.

IF LINE 7 IS LARGER THAN LINE 6, ENTER AMOUNT OF OVERPAYMENT

13.

❏

❏

PLEASE CHECK ONE: REFUND

CREDIT

(IF YOU FAIL TO DESIGNATE CREDIT OR REFUND, THE OVERPAYMENT WILL BE CREDITED)

Mail to: West Virginia State Tax Department

P. O. Box 425, Charleston, WV 25322-0425

For assistance call (304) 558-3333

or toll free 1-800-WVA-TAXS (982-8297)

Make checks payable to: West Virginia State Tax Department

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3