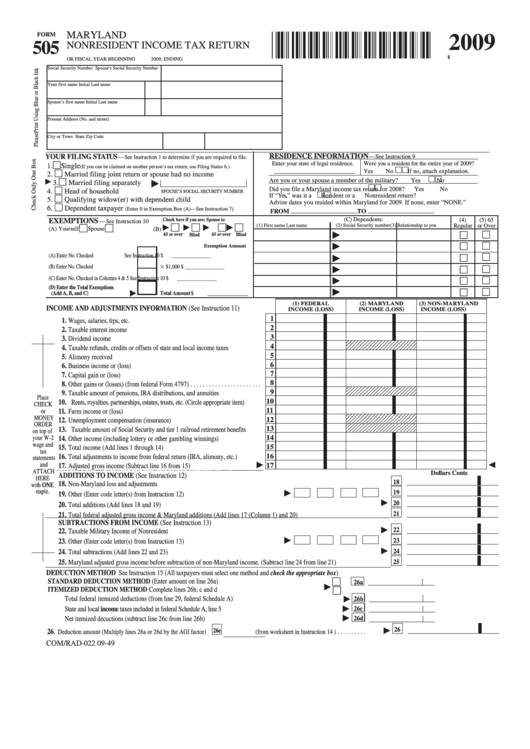

2009

FORM

MARYLAND

505

NONRESIDENT INCOME TAX RETURN

$

095050049

OR FISCAL YEAR BEGINNING

2009, ENDING

Social Security Number

Spouse's Social Security Number

Your first name

Initial

Last name

Spouse’s first name

Initial

Last name

Present Address (No. and street)

City or Town

State

Zip Code

RESIDENCE INFORMATION

YOUR FIlINg STATUS

—

See Instruction 9

—

See Instruction 1 to determine if you are required to file.

Enter your state of legal residence.

Were you a resident for the entire year of 2009?

1.

Single

(If you can be claimed on another person’s tax return, use Filing Status 6.)

_____________________________

Yes

No

If no, attach explanation.

2.

Married filing joint return or spouse had no income

Are you or your spouse a member of the military?

Yes

No

3.

Married filing separately

Did you file a Maryland income tax return for 2008?

Yes

No

4.

Head of household

SPOUSE’S SOCIAL SECURITY NUM BER

If “Yes,” was it a

Resident or a

Nonresident return?

5.

Qualifying widow(er) with dependent child

Advise dates you resided within Maryland for 2009. If none, enter “NONE.”

6.

Dependent taxpayer

(Enter 0 in Exemption Box (A)—See Instruction 7 )

FROM _____________________ TO _____________________

EXEMPTIONS

Check here if you are:

Spouse is:

(C) Dependents:

(4)

(5) 65

—

See Instruction 10

(1) First name

Last name

(2) Social Security number

(3) Relationship to you

Regular

or Over

(A) Yourself

Spouse

(B)

□

□

65 or over

Blind

65 or over

Blind

□

□

Exemption Amount

□

(A) Enter No. Checked. . . . . . . . . . . . . .

See Instruction 10

$ ________________

□

$1,000

(B) Enter No. Checked. . . . . . . . . . . . . .

$ ________________

□

□

(C) Enter No. Checked in Columns 4 & 5

See Instruction 10

$ ________________

□

□

(D) Enter the Total Exemptions

□

□

(Add A, B, and C)

Total Amount

$ ______________

(1) FEDERAl

(2) MARYlAND

(3) NON-MARYlAND

INCOME AND ADJUSTMENTS INFORMATION (See Instruction 11)

INCOME (lOSS)

INCOME (lOSS)

INCOME (lOSS)

1

1.

Wages, salaries, tips, etc.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2.

Taxable interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3.

Dividend income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

4.

Taxable refunds, credits or offsets of state and local income taxes. . . . . . . . . .

5

5.

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6.

Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7.

Capital gain or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8.

Other gains or (losses) (from federal Form 4797) . . . . . . . . . . . . . . . . . . . . . . .

9

9.

Taxable amount of pensions, IRA distributions, and annuities . . . . . . . . . . . . .

Place

10

10.

Rents, royalties, partnerships, estates, trusts, etc. (Circle appropriate item). . . . . .

CHECk

11

11.

or

Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MONEY

12

12.

Unemployment compensation (insurance) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

ORDER

13

13.

Taxable amount of Social Security and tier 1 railroad retirement benefits. . . . . .

on top of

14

14.

your W-2

Other income (including lottery or other gambling winnings) . . . . . . . . . . . . .

wage and

15

15.

Total income (Add lines 1 through 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

tax

16.

16

Total adjustments to income from federal return (IRA, alimony, etc.) . . . . . . .

statements

17

17.

and

Adjusted gross income (Subtract line 16 from 15) . . . . . . . . . . . . . . . . . . .

INCOME AND ADJUSTMENTS INFORMATION (See Instruction 1)

ATTACH

Dollars

Cents

ADDITIONS TO INCOME (See Instruction 12)

HERE

18

18.

with ONE

Non-Maryland loss and adjustments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

staple.

19.

Other (Enter code letter(s) from Instruction 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

20.

Total additions (Add lines 18 and 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

21.

Total federal adjusted gross income & Maryland additions (Add lines 17 (Column 1) and 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SUBTRACTIONS FROM INCOME (See Instruction 13)

22

22.

Taxable Military Income of Nonresident . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

23.

Other (Enter code letter(s) from Instruction 13). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24.

24

Total subtractions (Add lines 22 and 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25.

25

Maryland adjusted gross income before subtraction of non-Maryland income. (Subtract line 24 from line 21). . . . . . . . . . . . . . . .

DEDUCTION METHOD

See Instruction 15 (All taxpayers must select one method and check the appropriate box)

STANDARD DEDUCTION METHOD (Enter amount on line 26a)

26a

ITEMIZED DEDUCTION METHOD Complete lines 26b, c and d

26b

Total federal itemized deductions (from line 29, federal Schedule A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State and local income taxes included in federal Schedule A, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26c

26d

Net itemized decuctions (subtract line 26c from line 26b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26

26e

26

(from worksheet in Instruction 14 ) . . . . . . . . . .

. Deduction amount (Multiply lines 26a or 26d by the AGI factor)

COM/RAD-022

09-49

1

1 2

2