Form W-3 - Mantua Village Tax Reconciliation - 2010

ADVERTISEMENT

FORM W-3 Mantua Village Tax Reconciliation

Page 1 of 1

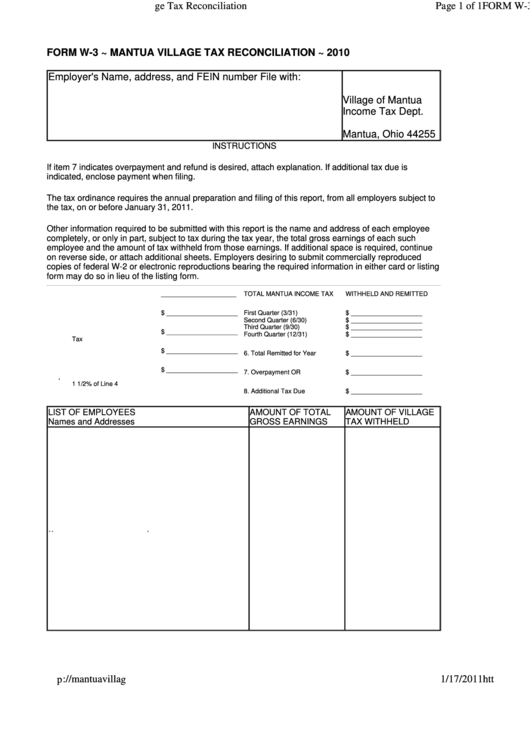

FORM W-3 ~ MANTUA VILLAGE TAX RECONCILIATION ~ 2010

Employer's Name, address, and FEIN number

File with:

Village of Mantua

Income Tax Dept.

P.O. Box 775

Mantua, Ohio 44255

INSTRUCTIONS

If item 7 indicates overpayment and refund is desired, attach explanation. If additional tax due is

indicated, enclose payment when filing.

The tax ordinance requires the annual preparation and filing of this report, from all employers subject to

the tax, on or before January 31, 2011.

Other information required to be submitted with this report is the name and address of each employee

completely, or only in part, subject to tax during the tax year, the total gross earnings of each such

employee and the amount of tax withheld from those earnings. If additional space is required, continue

on reverse side, or attach additional sheets. Employers desiring to submit commercially reproduced

copies of federal W-2 or electronic reproductions bearing the required information in either card or listing

form may do so in lieu of the listing form.

1.

Total Number of Employees

_____________________

TOTAL MANTUA INCOME TAX

WITHHELD AND REMITTED

2.

Total Payroll of the Year

$ ____________________

First Quarter (3/31)

$ ____________________

Second Quarter (6/30)

$ ____________________

Third Quarter (9/30)

$ ____________________

3.

Less Payroll Not Subject to

$ ____________________

Fourth Quarter (12/31)

$ ____________________

Tax

$ ____________________

6. Total Remitted for Year

$ ____________________

4.

Payroll Subject to Tax

$ ____________________

7. Overpayment OR

$ ____________________

5.

Withholding Tax Liability,

1 1/2% of Line 4

8. Additional Tax Due

$ ____________________

LIST OF EMPLOYEES

AMOUNT OF TOTAL

AMOUNT OF VILLAGE

Names and Addresses

GROSS EARNINGS

TAX WITHHELD

.

.

.

1/17/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1