Form W-2 - Income Tax Information

ADVERTISEMENT

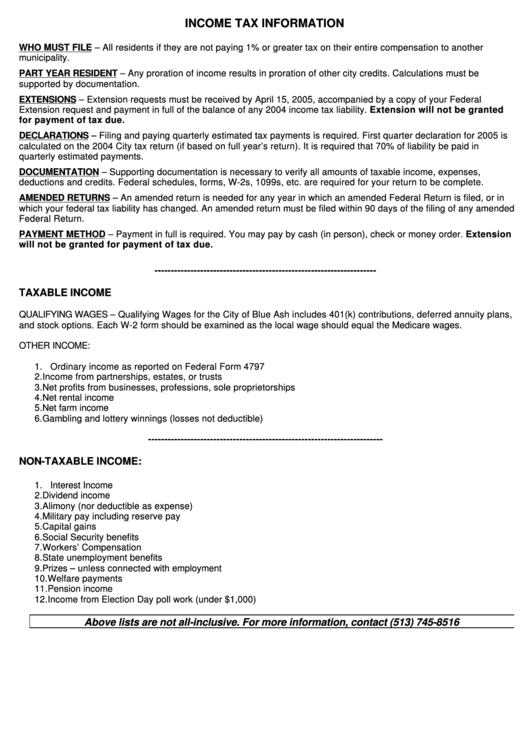

INCOME TAX INFORMATION

WHO MUST FILE – All residents if they are not paying 1% or greater tax on their entire compensation to another

municipality.

PART YEAR RESIDENT – Any proration of income results in proration of other city credits. Calculations must be

supported by documentation.

EXTENSIONS – Extension requests must be received by April 15, 2005, accompanied by a copy of your Federal

Extension request and payment in full of the balance of any 2004 income tax liability. Extension will not be granted

for payment of tax due.

DECLARATIONS – Filing and paying quarterly estimated tax payments is required. First quarter declaration for 2005 is

calculated on the 2004 City tax return (if based on full year’s return). It is required that 70% of liability be paid in

quarterly estimated payments.

DOCUMENTATION – Supporting documentation is necessary to verify all amounts of taxable income, expenses,

deductions and credits. Federal schedules, forms, W-2s, 1099s, etc. are required for your return to be complete.

AMENDED RETURNS – An amended return is needed for any year in which an amended Federal Return is filed, or in

which your federal tax liability has changed. An amended return must be filed within 90 days of the filing of any amended

Federal Return.

PAYMENT METHOD – Payment in full is required. You may pay by cash (in person), check or money order. Extension

will not be granted for payment of tax due.

--------------------------------------------------------------------

TAXABLE INCOME

QUALIFYING WAGES – Qualifying Wages for the City of Blue Ash includes 401(k) contributions, deferred annuity plans,

and stock options. Each W-2 form should be examined as the local wage should equal the Medicare wages.

OTHER INCOME:

1. Ordinary income as reported on Federal Form 4797

2. Income from partnerships, estates, or trusts

3. Net profits from businesses, professions, sole proprietorships

4. Net rental income

5. Net farm income

6. Gambling and lottery winnings (losses not deductible)

------------------------------------------------------------------------

NON-TAXABLE INCOME:

1. Interest Income

2. Dividend income

3. Alimony (nor deductible as expense)

4. Military pay including reserve pay

5. Capital gains

6. Social Security benefits

7. Workers’ Compensation

8. State unemployment benefits

9. Prizes – unless connected with employment

10. Welfare payments

11. Pension income

12. Income from Election Day poll work (under $1,000)

Above lists are not all-inclusive. For more information, contact (513) 745-8516

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1