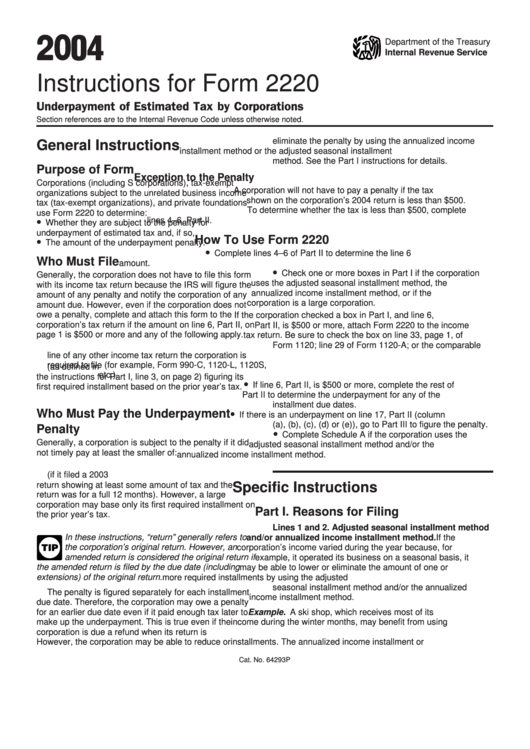

Instructions For Form 2220 - Underpayment Of Estimated Tax By Corporations - 2004

ADVERTISEMENT

04

2 0

Department of the Treasury

Internal Revenue Service

Instructions for Form 2220

Underpayment of Estimated Tax by Corporations

Section references are to the Internal Revenue Code unless otherwise noted.

eliminate the penalty by using the annualized income

General Instructions

installment method or the adjusted seasonal installment

method. See the Part I instructions for details.

Purpose of Form

Exception to the Penalty

Corporations (including S corporations), tax-exempt

A corporation will not have to pay a penalty if the tax

organizations subject to the unrelated business income

shown on the corporation’s 2004 return is less than $500.

tax (tax-exempt organizations), and private foundations

To determine whether the tax is less than $500, complete

use Form 2220 to determine:

•

lines 4 –6, Part II.

Whether they are subject to the penalty for

underpayment of estimated tax and, if so,

How To Use Form 2220

•

The amount of the underpayment penalty.

•

Complete lines 4 –6 of Part II to determine the line 6

Who Must File

amount.

•

Check one or more boxes in Part I if the corporation

Generally, the corporation does not have to file this form

uses the adjusted seasonal installment method, the

with its income tax return because the IRS will figure the

annualized income installment method, or if the

amount of any penalty and notify the corporation of any

corporation is a large corporation.

amount due. However, even if the corporation does not

owe a penalty, complete and attach this form to the

If the corporation checked a box in Part I, and line 6,

corporation’s tax return if the amount on line 6, Part II, on

Part II, is $500 or more, attach Form 2220 to the income

page 1 is $500 or more and any of the following apply.

tax return. Be sure to check the box on line 33, page 1, of

Form 1120; line 29 of Form 1120-A; or the comparable

1. The adjusted seasonal installment method is used.

line of any other income tax return the corporation is

2. The annualized income installment method is used.

required to file (for example, Form 990-C, 1120-L, 1120S,

3. The corporation is a large corporation (as defined in

etc.).

the instructions for Part I, line 3, on page 2) figuring its

•

If line 6, Part II, is $500 or more, complete the rest of

first required installment based on the prior year’s tax.

Part II to determine the underpayment for any of the

installment due dates.

•

Who Must Pay the Underpayment

If there is an underpayment on line 17, Part II (column

(a), (b), (c), (d) or (e)), go to Part III to figure the penalty.

Penalty

•

Complete Schedule A if the corporation uses the

Generally, a corporation is subject to the penalty if it did

adjusted seasonal installment method and/or the

not timely pay at least the smaller of:

annualized income installment method.

1. The tax shown on its 2004 return or

2. The tax shown on its 2003 return (if it filed a 2003

return showing at least some amount of tax and the

Specific Instructions

return was for a full 12 months). However, a large

corporation may base only its first required installment on

Part I. Reasons for Filing

the prior year’s tax.

Lines 1 and 2. Adjusted seasonal installment method

In these instructions, “return” generally refers to

and/or annualized income installment method. If the

the corporation’s original return. However, an

corporation’s income varied during the year because, for

TIP

amended return is considered the original return if

example, it operated its business on a seasonal basis, it

the amended return is filed by the due date (including

may be able to lower or eliminate the amount of one or

extensions) of the original return.

more required installments by using the adjusted

seasonal installment method and/or the annualized

The penalty is figured separately for each installment

income installment method.

due date. Therefore, the corporation may owe a penalty

for an earlier due date even if it paid enough tax later to

Example. A ski shop, which receives most of its

make up the underpayment. This is true even if the

income during the winter months, may benefit from using

corporation is due a refund when its return is filed.

one or both of these methods to figure its required

However, the corporation may be able to reduce or

installments. The annualized income installment or

Cat. No. 64293P

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4