Print and Reset Form

Reset Form

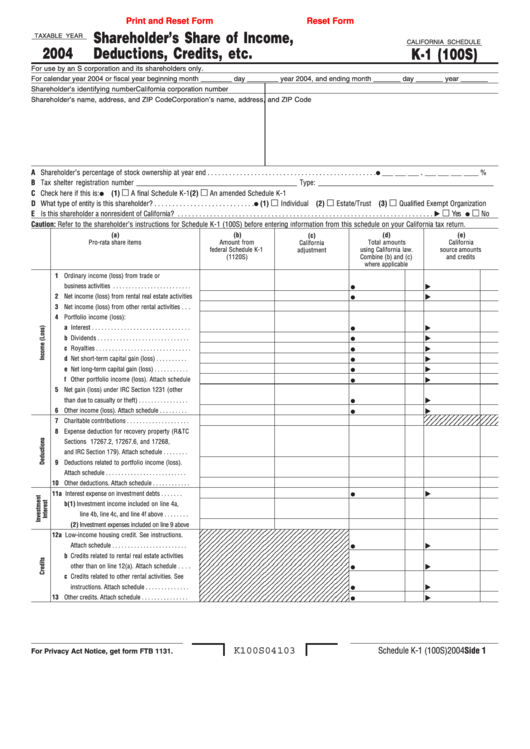

Shareholder’s Share of Income,

TAXABLE YEAR

CALIFORNIA SCHEDULE

2004

Deductions, Credits, etc.

K-1 (100S)

For use by an S corporation and its shareholders only.

For calendar year 2004 or fiscal year beginning month ________ day ________ year 2004, and ending month _______ day _______ year _______

Shareholder’s identifying number

California corporation number

Shareholder’s name, address, and ZIP Code

Corporation’s name, address, and ZIP Code

¼

.

A Shareholder’s percentage of stock ownership at year end . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

___ ___ ___

___ ___ ___ ____ %

B Tax shelter registration number ____________________________________________ Type: ________________________________________________

¼

C Check here if this is:

(1)

A final Schedule K-1

(2)

An amended Schedule K-1

¼

D What type of entity is this shareholder? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(1)

Individual (2)

Estate/Trust (3)

Qualified Exempt Organization

¼

E Is this shareholder a nonresident of California? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Caution: Refer to the shareholder’s instructions for Schedule K-1 (100S) before entering information from this schedule on your California tax return.

(a)

(b)

(d)

(e)

(c)

Pro-rata share items

Amount from

Total amounts

California

California

federal Schedule K-1

using California law.

source amounts

adjustment

(1120S)

Combine (b) and (c)

and credits

where applicable

1 Ordinary income (loss) from trade or

¼

business activities . . . . . . . . . . . . . . . . . . . . . . . . .

¼

2 Net income (loss) from rental real estate activities

3 Net income (loss) from other rental activities . . .

4 Portfolio income (loss):

¼

a Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

b Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

c Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

¼

d Net short-term capital gain (loss) . . . . . . . . . .

¼

e Net long-term capital gain (loss) . . . . . . . . . . .

¼

f Other portfolio income (loss). Attach schedule

5 Net gain (loss) under IRC Section 1231 (other

¼

than due to casualty or theft) . . . . . . . . . . . . . . . .

¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

6 Other income (loss). Attach schedule . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

7 Charitable contributions . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

8 Expense deduction for recovery property (R&TC

Sections 17267.2, 17267.6, and 17268,

and IRC Section 179). Attach schedule . . . . . . . .

9 Deductions related to portfolio income (loss).

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Other deductions. Attach schedule . . . . . . . . . . . .

¼

11 a Interest expense on investment debts . . . . . . .

b (1) Investment income included on line 4a,

line 4b, line 4c, and line 4f above . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

(2) Investment expenses included on line 9 above

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

12 a Low-income housing credit. See instructions.

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

¼

Attach schedule . . . . . . . . . . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

b Credits related to rental real estate activities

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

¼

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

other than on line 12(a). Attach schedule . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

c Credits related to other rental activities. See

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

¼

instructions. Attach schedule . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

¼

13 Other credits. Attach schedule . . . . . . . . . . . . . . .

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

K100S04103

Schedule K-1 (100S) 2004 Side 1

For Privacy Act Notice, get form FTB 1131.

1

1 2

2