Form Np-1 - Net Profit License Fee Return

ADVERTISEMENT

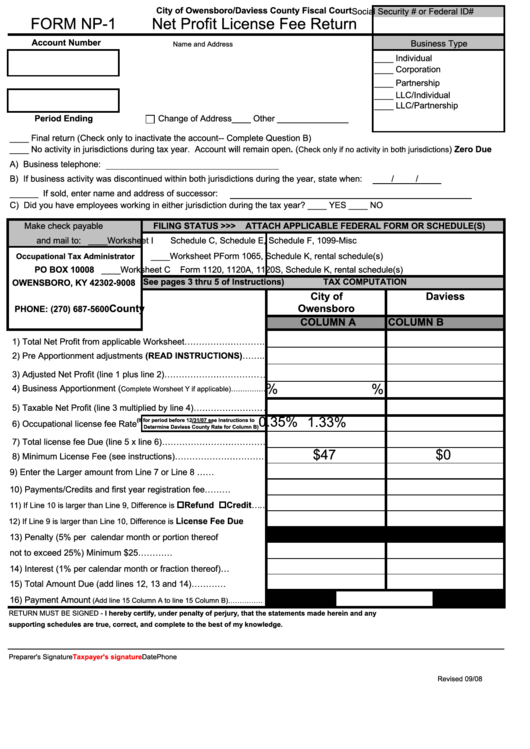

City of Owensboro/Daviess County Fiscal Court

Social Security # or Federal ID#

FORM NP-1

Net Profit License Fee Return

Account Number

Business Type

Name and Address

____ Individual

____ Corporation

____ Partnership

____ LLC/Individual

____ LLC/Partnership

Period Ending

Change of Address

____ Other _______________

____ Final return (Check only to inactivate the account-- Complete Question B)

____ No activity in jurisdictions during tax year. Account will remain open. (

) Zero Due

Check only if no activity in both jurisdictions

A) Business telephone:

B) If business activity was discontinued within both jurisdictions during the year, state when:

/

/

______ If sold, enter name and address of successor:

C) Did you have employees working in either jurisdiction during the tax year? ____ YES ____ NO

Make check payable

FILING STATUS >>>

ATTACH APPLICABLE FEDERAL FORM OR SCHEDULE(S)

and mail to:

____Worksheet I

Schedule C, Schedule E, Schedule F, 1099-Misc

____Worksheet P

Form 1065, Schedule K, rental schedule(s)

Occupational Tax Administrator

PO BOX 10008

____Worksheet C

Form 1120, 1120A, 1120S, Schedule K, rental schedule(s)

(See pages 3 thru 5 of Instructions)

TAX COMPUTATION

OWENSBORO, KY 42302-9008

City of

Daviess

Owensboro

County

PHONE: (270) 687-5600

COLUMN A

COLUMN B

1) Total Net Profit from applicable Worksheet……………………….

2) Pre Apportionment adjustments (READ INSTRUCTIONS)……..

3) Adjusted Net Profit (line 1 plus line 2)………………………………

%

%

4) Business Apportionment (

Complete Worsheet Y if applicable)……………

5) Taxable Net Profit (line 3 multiplied by line 4)………………………

1.33%

0.35%

(If for period before 12/31/07 see Instructions to

6) Occupational license fee Rate

Determine Daviess County Rate for Column B)

7) Total license fee Due (line 5 x line 6)………………………………

$47

$0

8) Minimum License Fee (see instructions)………………………….

9) Enter the Larger amount from Line 7 or Line 8 ……....................

10) Payments/Credits and first year registration fee………...............

Refund

Credit……

11) If Line 10 is larger than Line 9, Difference is

License Fee Due..........

12) If Line 9 is larger than Line 10, Difference is

13) Penalty (5% per calendar month or portion thereof

not to exceed 25%) Minimum $25…………...................

14) Interest (1% per calendar month or fraction thereof)…..............

15) Total Amount Due (add lines 12, 13 and 14)…………................

16) Payment Amount

(Add line 15 Column A to line 15 Column B)……………

RETURN MUST BE SIGNED - I hereby certify, under penalty of perjury, that the statements made herein and any

supporting schedules are true, correct, and complete to the best of my knowledge.

Preparer's Signature

Phone

Taxpayer's signature

Date

Revised 09/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1