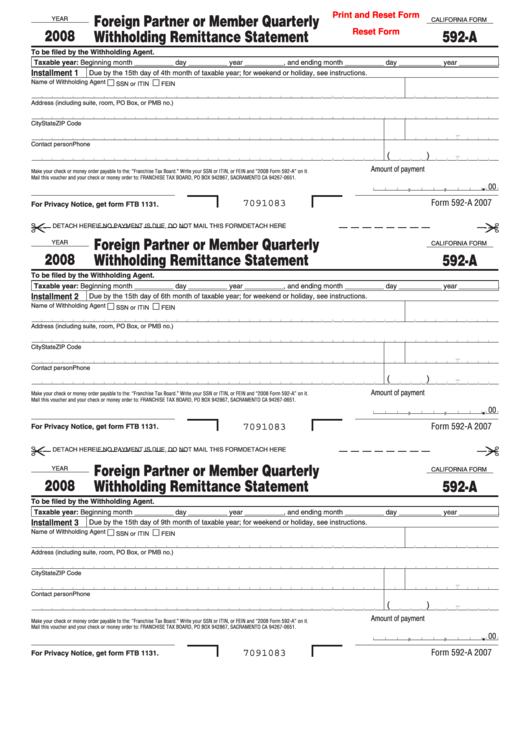

Foreign Partner or Member Quarterly

Print and Reset Form

YEAR

CALIFORNIA FORM

2008

Withholding Remittance Statement

592-A

Reset Form

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 1

Due by the 15th day of 4th month of taxable year; for weekend or holiday, see instructions.

Name of Withholding Agent

SSN or ITIN

FEIN

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Contact person

Phone

-

(

)

Amount of payment

Make your check or money order payable to the: “Franchise Tax Board.” Write your SSN or ITIN, or FEIN and “2008 Form 592-A” on it.

Mail this voucher and your check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651.

.

00

,

,

Form 592-A 2007

7091083

For Privacy Notice, get form FTB 1131.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

Foreign Partner or Member Quarterly

YEAR

CALIFORNIA FORM

Withholding Remittance Statement

2008

592-A

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 2

Due by the 15th day of 6th month of taxable year; for weekend or holiday, see instructions.

Name of Withholding Agent

SSN or ITIN

FEIN

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Contact person

Phone

-

(

)

Amount of payment

Make your check or money order payable to the: “Franchise Tax Board.” Write your SSN or ITIN, or FEIN and “2008 Form 592-A” on it.

Mail this voucher and your check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651.

.

00

,

,

Form 592-A 2007

7091083

For Privacy Notice, get form FTB 1131.

DETACH HERE

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

Foreign Partner or Member Quarterly

YEAR

CALIFORNIA FORM

2008

Withholding Remittance Statement

592-A

To be filed by the Withholding Agent.

Taxable year: Beginning month __________ day __________ year __________, and ending month __________ day ___________ year __________.

Installment 3

Due by the 15th day of 9th month of taxable year; for weekend or holiday, see instructions.

Name of Withholding Agent

SSN or ITIN

FEIN

Address (including suite, room, PO Box, or PMB no.)

City

State

ZIP Code

-

Contact person

Phone

-

(

)

Amount of payment

Make your check or money order payable to the: “Franchise Tax Board.” Write your SSN or ITIN, or FEIN and “2008 Form 592-A” on it.

Mail this voucher and your check or money order to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0651.

.

00

,

,

Form 592-A 2007

7091083

For Privacy Notice, get form FTB 1131.

1

1 2

2