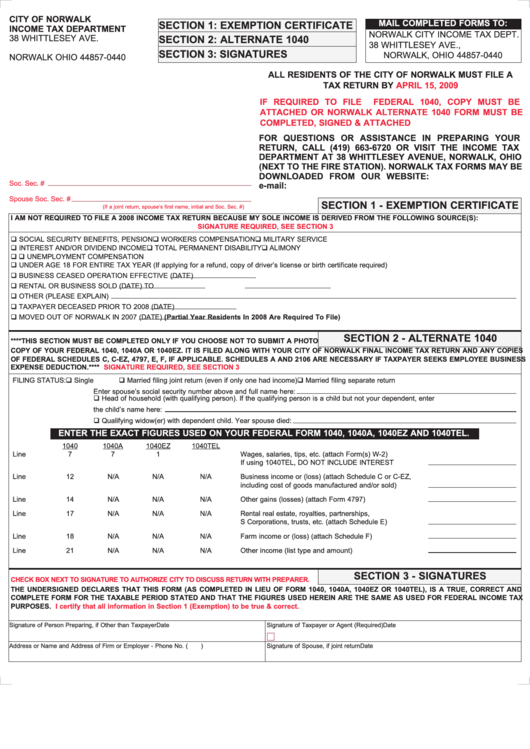

City Of Norwalk Income Tax Department Form - 2008

ADVERTISEMENT

CITY OF NORWALK

MAIL COMPLETED FORMS TO:

SECTION 1: EXEMPTION CERTIFICATE

INCOME TAX DEPARTMENT

NORWALK CITY INCOME TAX DEPT.

38 WHITTLESEY AVE.

SECTION 2: ALTERNATE 1040

38 WHITTLESEY AVE., P.O. BOX 440

P.O. BOX 440

SECTION 3: SIGNATURES

NORWALK, OHIO 44857-0440

NORWALK OHIO 44857-0440

ALL RESIDENTS OF THE CITY OF NORWALK MUST FILE A

TAX RETURN BY

APRIL 15, 2009

IF REQUIRED TO FILE

FEDERAL 1040, COPY MUST BE

ATTACHED OR NORWALK ALTERNATE 1040 FORM MUST BE

COMPLETED, SIGNED & ATTACHED

FOR QUESTIONS OR ASSISTANCE IN PREPARING YOUR

RETURN, CALL (419) 663-6720 OR VISIT THE INCOME TAX

DEPARTMENT AT 38 WHITTLESEY AVENUE, NORWALK, OHIO

(NEXT TO THE FIRE STATION). NORWALK TAX FORMS MAY BE

DOWNLOADED FROM OUR WEBSITE:

Soc. Sec. #

e-mail:

Spouse Soc. Sec. #

SECTION 1 - EXEMPTION CERTIFICATE

(If a joint return, spouse’s first name, initial and Soc. Sec. #)

I AM NOT REQUIRED TO FILE A 2008 INCOME TAX RETURN BECAUSE MY SOLE INCOME IS DERIVED FROM THE FOLLOWING SOURCE(S):

SIGNATURE REQUIRED, SEE SECTION 3

SOCIAL SECURITY BENEFITS, PENSION

WORKERS COMPENSATION

MILITARY SERVICE

INTEREST AND/OR DIVIDEND INCOME

TOTAL PERMANENT DISABILITY

ALIMONY

A.D.C./GENERAL PUBLIC ASSISTANCE

UNEMPLOYMENT COMPENSATION

UNDER AGE 18 FOR ENTIRE TAX YEAR (If applying for a refund, copy of driver’s license or birth certificate required)

BUSINESS CEASED OPERATION EFFECTIVE

(DATE)

RENTAL OR BUSINESS SOLD

(DATE) TO

OTHER (PLEASE EXPLAIN)

TAXPAYER DECEASED PRIOR TO 2008

(DATE)

MOVED OUT OF NORWALK IN 2007

(DATE) (Partial Year Residents In 2008 Are Required To File)

SECTION 2 - ALTERNATE 1040

****THIS SECTION MUST BE COMPLETED ONLY IF YOU CHOOSE NOT TO SUBMIT A PHOTO

COPY OF YOUR FEDERAL 1040, 1040A OR 1040EZ. IT IS FILED ALONG WITH YOUR CITY OF NORWALK FINAL INCOME TAX RETURN AND ANY COPIES

OF FEDERAL SCHEDULES C, C-EZ, 4797, E, F, IF APPLICABLE. SCHEDULES A AND 2106 ARE NECESSARY IF TAXPAYER SEEKS EMPLOYEE BUSINESS

EXPENSE DEDUCTION.****

SIGNATURE REQUIRED, SEE SECTION 3

FILING STATUS:

Single

Married filing joint return (even if only one had income)

Married filing separate return

Enter spouse’s social security number above and full name here:

Head of household (with qualifying person). If the qualifying person is a child but not your dependent, enter

the child’s name here:

Qualifying widow(er) with dependent child. Year spouse died:

ENTER THE EXACT FIGURES USED ON YOUR FEDERAL FORM 1040, 1040A, 1040EZ AND 1040TEL.

1040

1040A

1040EZ

1040TEL

Line

7

7

1

Wages, salaries, tips, etc. (attach Form(s) W-2)

If using 1040TEL, DO NOT INCLUDE INTEREST

Line

12

N/A

N/A

N/A

Business income or (loss) (attach Schedule C or C-EZ,

including cost of goods manufactured and/or sold)

Line

14

N/A

N/A

N/A

Other gains (losses) (attach Form 4797)

Line

17

N/A

N/A

N/A

Rental real estate, royalties, partnerships,

S Corporations, trusts, etc. (attach Schedule E)

Line

18

N/A

N/A

N/A

Farm income or (loss) (attach Schedule F)

Line

21

N/A

N/A

N/A

Other income (list type and amount)

SECTION 3 - SIGNATURES

CHECK BOX NEXT TO SIGNATURE TO AUTHORIZE CITY TO DISCUSS RETURN WITH PREPARER.

THE UNDERSIGNED DECLARES THAT THIS FORM (AS COMPLETED IN LIEU OF FORM 1040, 1040A, 1040EZ OR 1040TEL), IS A TRUE, CORRECT AND

COMPLETE FORM FOR THE TAXABLE PERIOD STATED AND THAT THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX

PURPOSES.

I certify that all information in Section 1 (Exemption) to be true & correct.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

Address or Name and Address of Firm or Employer - Phone No. (

)

Signature of Spouse, if joint return

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1