Form Wcwt-6 - Net Profits Tax Return Instructions

ADVERTISEMENT

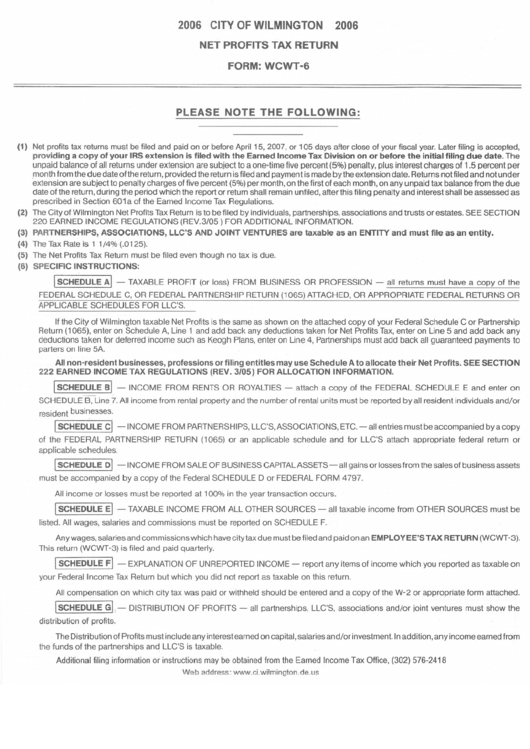

2006 CITY OF WILMINGTON

2006

NET PROFITS TAX RETURN

FORM: WCWT-6

PLEASE

NOTE THE FOllOWING:

(1) Net profits tax returns must be filed and paid on or before April 15, 2007, or 105 days after close of your fiscal year. Later filing is accepted,

providing

a copy of your IRS extension

is filed with the Earned

Income Tax Division on or before the initial filing due date. The

unpaid balance of all returns under extension are subject to a one-time five percent (5%) penalty, plus interest charges of 1.5 percent per

month from the due date ofthe return, provided the return is filed and payment is made by the extension date. Returns notfiled and not under

extension are subject to penalty charges of five percent (5%) per month, on the first of each month, on any unpaid tax balance from the due

date of the return, during the period which the report or return shall remain unfiled, after this filing penalty and interest shall be assessed as

prescribed in Section 601 a of the Earned Income Tax Regulations.

(2) The City of Wilmington Net Profits Tax Return is to be filed by individuals, partnerships, associations and trusts or estates. SEE SECTION

220 EARNED INCOME REGULATIONS (REV.3/05 ) FOR ADDITIONAL INFORMATION.

(3) PARTNERSHIPS,

ASSOCIATIONS,

LLC'S AND JOINT VENTURES are taxable

as an ENTITY and must file as an entity.

(4) The Tax Rate is 1 1/4% (.0125).

(5) The Net Profits Tax Return must be filed even though no tax is due.

(6) SPECIFIC

INSTRUCTIONS:

I

SCHEDULE AI -

TAXABLE PROFIT (or loss) FROM BUSINESS OR PROFESSION -

all returns must have a copy of the

FEDERAL SCHEDULE C, OR FEDERAL PARTNERSHIP RETURN (1065) ATTACHED, OR APPROPRIATE FEDERAL RETURNS OR

APPLICABLE SCHEDULES FOR LLC'S.

If the City of Wilmington taxable Net Profits is the same as shown on the attached copy of your Federal Schedule C or Partnership

Return (1065), enter on Schedule A, Line 1 and add back any deductions taken for Net Profits Tax, enter on Line 5 and add back any

deductions taken for deferred income such as Keogh Plans, enter on Line 4, Partnerships must add back all guaranteed payments to

parters on line5A.

All non-resident

businesses,

professions

or filing entitles

may use Schedule

A to allocate their Net Profits. SEE SECTION

222 EARNED INCOME TAX REGULATIONS (REV. 3/05) FOR ALLOCATION INFORMATION.

I

SCHEDULE 81

-

INCOME FROM RENTS OR ROYALTIES

-

attach a copy of the FEDERAL SCHEDULE E and enter on

SCHEDULE B, Line

7.

All income from rental property and the number of rental units must be reported by all resident individuals and/or

resident businesses.

I

SCHEDULE CI. -INCOME FROMPARTNERSHIPS,LLC'S,ASSOCIATIONS,

ETC. - all entries must be accompanied by a copy

of the FEDERAL PARTNERSHIP RETURN (1065) or an applicable schedule and for LLC'S attach appropriate federal return or

applicable schedules.

I

SCHEDULE DI -INCOME FROMSALEOF BUSINESSCAPITAL

ASSETS - all gains or losses from the sales of business assets

must be accompanied by a copy of the Federal SCHEDULE D or FEDERAL FORM 4797.

All income or losses must be reported at 100% in the year transaction occurs.

I

SCHEDULE EI

-

TAXABLE INCOME FROM ALL OTHER SOURCES -

all taxable income from OTHER SOURCES must be

listed. All wages, salaries and commissions must be reported on SCHEDULE F.

Any wages, salaries and commissions which have city tax due must be filed and paid on an EMPLOYEE'S TAX RETURN (WCWT-3).

This return (WCWT-3) is filed and paid quarterly.

I

SCHEDULE FI - EXPLANATION OF UNREPORTED INCOME -

report any items of income which you reported as taxable on

your Federal Income Tax Return but which you did not report as taxable on this return.

All compensation on which city tax was paid or withheld should be entered and a copy of the W-2 or appropriate form attached.

I

SCHEDULE GIi-DISTRIBUTION

OF PROFITS -

all partnerships, LLC'S, associations and/or joint ventures must show the

distribution of profits.

The Distribution of Profits must include any interest earned on capital, salaries and/or investment. In addition, any income earned from

the funds of the partnerships and LLC'S is taxable.

Additional filing information or instructions may be obtained from the Earned Income Tax Office, (302) 576-2418

Web address:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1