Form W-1 - Employer'S Return Of Tax Withheld - City Of Hubbard

ADVERTISEMENT

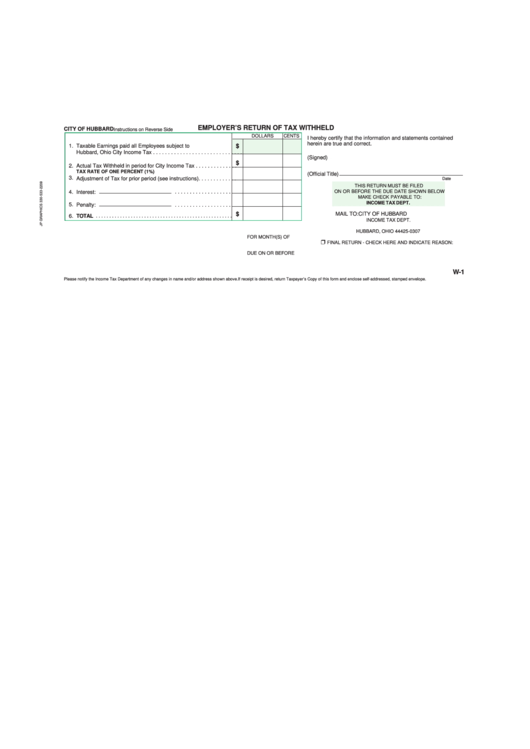

EMPLOYER’S RETURN OF TAX WITHHELD

CITY OF HUBBARD

Instructions on Reverse Side

DOLLARS

CENTS

I hereby certify that the information and statements contained

herein are true and correct.

1.

Taxable Earnings paid all Employees subject to

$

Hubbard, Ohio City Income Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Signed)

$

2.

Actual Tax Withheld in period for City Income Tax . . . . . . . . . . . . . .

TAX RATE OF ONE PERCENT (1%)

(Official Title)

3.

Adjustment of Tax for prior period (see instructions). . . . . . . . . . . . .

Date

THIS RETURN MUST BE FILED

. . . . . . . . . . . . . . . . . . .

ON OR BEFORE THE DUE DATE SHOWN BELOW

4.

Interest:

MAKE CHECK PAYABLE TO:

INCOME TAX DEPT.

5.

Penalty:

. . . . . . . . . . . . . . . . . . .

$

MAIL TO:

CITY OF HUBBARD

6.

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

INCOME TAX DEPT.

P.O. BOX 307

HUBBARD, OHIO 44425-0307

FOR MONTH(S) OF

FINAL RETURN - CHECK HERE AND INDICATE REASON:

DUE ON OR BEFORE

W-1

Please notify the Income Tax Department of any changes in name and/or address shown above.

If receipt is desired, return Taxpayer’s Copy of this form and enclose self-addressed, stamped envelope.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1