Form It-4708es - Estimated Income Tax Payment Worksheet - 2004

ADVERTISEMENT

Ohio IT 4708ES Instructions and Worksheet

IT 4708ES

Rev.

12/03

Estimated Income Tax Payments for Investors in Pass-Through Entities

Having a Calendar Year or Fiscal Year Ending in 2004

1. Who may use Form IT 4708ES?

Example: A pass-through entity has a November 30 fiscal

year end. For the fiscal year ending November 30, 2004 the

Any pass-through entity (e.g., S corporation, partnership, and

estimates would be due on April 15, 2004; June 15, 2004;

LLC's treated as a partnership for federal income tax purposes)

September 15, 2004; and January 15, 2005. These estimates

that elects to file a single (composite) annual income tax re-

would be based upon either (i) income (or annualized income)

turn on behalf of one, some, or all of its noncorporate investors

and that is required to make estimated payments.

for the fiscal year ending November 30, 2004, or (ii) income

for the fiscal year ending November 30, 2003. If the pass-

through entity makes payments based upon the fiscal year

Those electing to make estimated composite income tax re-

ending November 30, 2003, then the pass-through entity must

turn payments cannot claim personal exemptions or credits,

cannot claim nonbusiness credits and must pay at the high-

pay in 100% rather than 90% of the tax due.

est rate, 7.5%.

All pass-through entities must use payment coupon form IT

2. When is Form IT 4708ES required to be filed?

4708ES. If the composite annual income tax return, Ohio form

IT 4708, filed for the taxable year ending in 2003 reflected an

overpayment carryforward, that amount should be applied to

The pass-through entity must file estimated income tax pay-

reduce the first estimated tax payment.

ments along with Form IT-4708ES if the combined estimated

2004 Ohio taxes after credits will be more than $500.

Make checks payable to: Ohio Treasurer of State and

mail to:

3. Time and Place for Filing and Payment

Ohio Department of Taxation

P.O. Box 181140

By April 15, 2004 each calendar year pass-through entity

Columbus, OH 43218-1140

must pay at least 22.5% of the tax due. Subsequent pay-

ments are due as follows:

4. Interest Penalty

June 15, 2004

45%

of the current year tax due

less previous payments

If income taxes are underpaid, the pass-through entity must

add an interest penalty to the taxes for the taxable year at the

Sept. 15, 2004

67.5% of the current year tax due

less previous payments

rate per annum prescribed by Ohio Revised Code section

5703.47. See Ohio form IT 2210 available on our web site at

Jan. 18, 2005

90%

of the current year tax due

less previous payments

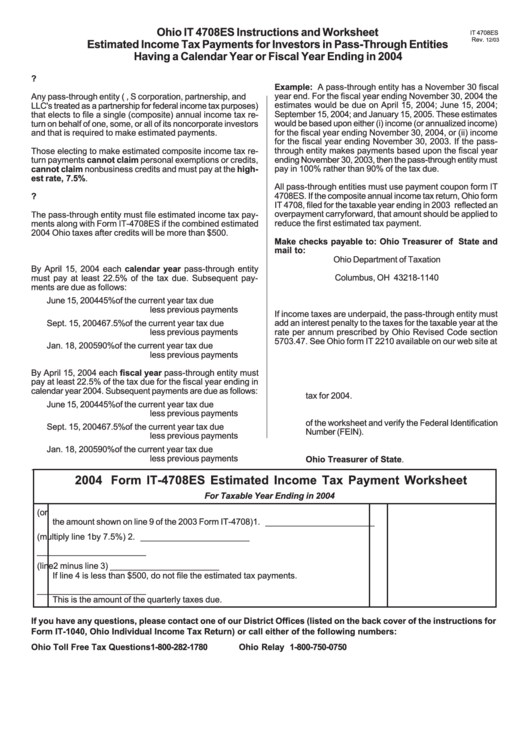

5. Completing Form IT 4708ES

By April 15, 2004 each fiscal year pass-through entity must

pay at least 22.5% of the tax due for the fiscal year ending in

a. Complete the worksheet below to figure the estimated

calendar year 2004. Subsequent payments are due as follows:

tax for 2004.

June 15, 2004

45%

of the current year tax due

less previous payments

b. Enter on form IT 4708ES the amount shown onl ine 5

of the worksheet and verify the Federal Identification

Sept. 15, 2004

67.5% of the current year tax due

Number (FEIN).

less previous payments

Jan. 18, 2005

90%

of the current year tax due

c. Attach check or money order made payable to the

less previous payments

Ohio Treasurer of State.

.

2004 Form IT-4708ES Estimated Income Tax Payment Worksheet

For Taxable Year Ending in 2004

1. Combined 2004 Apportioned and Allocated Distributive Share of Income (or

the amount shown on line 9 of the 2003 Form IT-4708) ............................................... 1. _______________________

2. Tax (multiply line 1 by 7.5%) ...................................................................................... 2. _______________________

3. Combined Distributive Share of Business Income Credits .......................................... 3. _______________________

4. Tax After Credits (line 2 minus line 3) ......................................................................... 4. _______________________

If line 4 is less than $500, do not file the estimated tax payments.

5. Multiply the amount on line 4 by 0.225....................................................................... 5. _______________________

This is the amount of the quarterly taxes due.

If you have any questions, please contact one of our District Offices (listed on the back cover of the instructions for

Form IT-1040, Ohio Individual Income Tax Return) or call either of the following numbers:

Ohio Toll Free Tax Questions ............................ 1-800-282-1780

Ohio Relay Sevice .................... 1-800-750-0750

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1