Request For Automatic Extension Of Time To File A Business Or Individual Income Tax Return - 2011

ADVERTISEMENT

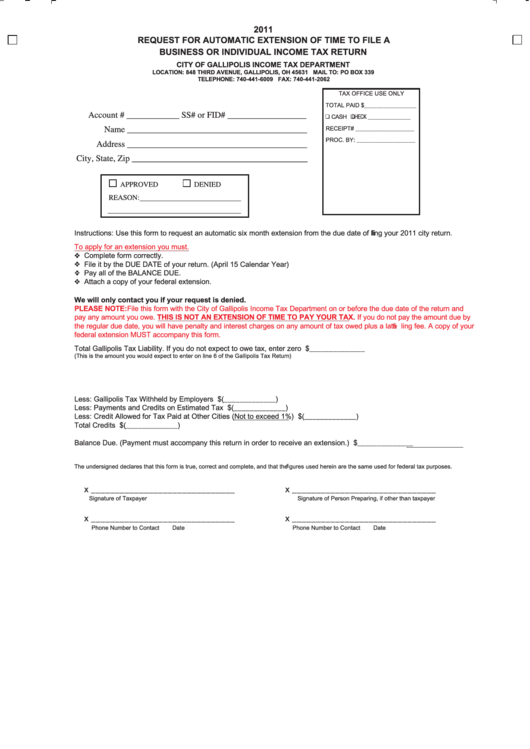

2011

REQUEST FOR AUTOMATIC EXTENSION OF TIME TO FILE A

BUSINESS OR INDIVIDUAL INCOME TAX RETURN

CITY OF GALLIPOLIS INCOME TAX DEPARTMENT

LOCATION: 848 THIRD AVENUE, GALLIPOLIS, OH 45631 MAIL TO: PO BOX 339

TELEPHONE: 740-441-6009 FAX: 740-441-2062

TAX OFFICE USE ONLY

TOTAL PAID $________________

Account # ____________ SS# or FID# __________________

CASH

CHECK ______________

Name _________________________________________

RECEIPT# __________________

PROC. BY: __________________

Address _________________________________________

City, State, Zip ________________________________________

APPROVED

DENIED

REASON:

Instructions: Use this form to request an automatic six month extension from the due date of ling your 2011 city return.

To apply for an extension you must.

Complete form correctly.

File it by the DUE DATE of your return. (April 15 Calendar Year)

Pay all of the BALANCE DUE.

Attach a copy of your federal extension.

We will only contact you if your request is denied.

PLEASE NOTE: File this form with the City of Gallipolis Income Tax Department on or before the due date of the return and

pay any amount you owe. THIS IS NOT AN EXTENSION OF TIME TO PAY YOUR TAX. If you do not pay the amount due by

the regular due date, you will have penalty and interest charges on any amount of tax owed plus a late ling fee. A copy of your

federal extension MUST accompany this form.

Total Gallipolis Tax Liability. If you do not expect to owe tax, enter zero .................................................. $______________

(This is the amount you would expect to enter on line 6 of the Gallipolis Tax Return)

Less: Gallipolis Tax Withheld by Employers .............................................................. $(_____________)

Less: Payments and Credits on Estimated Tax ......................................................... $(_____________)

Less: Credit Allowed for Tax Paid at Other Cities (Not to exceed 1%) ...................... $(_____________)

Total Credits .............................................................................................................................................. $(_____________)

Balance Due. (Payment must accompany this return in order to receive an extension.) ......................... $______________

The undersigned declares that this form is true, correct and complete, and that the gures used herein are the same used for federal tax purposes.

x ______________________________

x ______________________________

Signature of Taxpayer

Signature of Person Preparing, if other than taxpayer

x ______________________________

x ______________________________

Phone Number to Contact

Date

Phone Number to Contact

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1