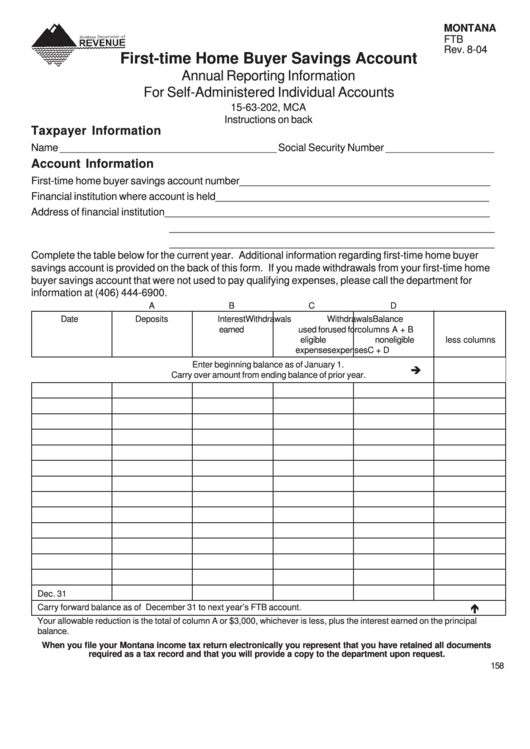

MONTANA

FTB

Rev. 8-04

First-time Home Buyer Savings Account

Annual Reporting Information

For Self-Administered Individual Accounts

15-63-202, MCA

Instructions on back

Taxpayer Information

Name ______________________________________ Social Security Number ___________________

Account Information

First-time home buyer savings account number ____________________________________________

Financial institution where account is held ________________________________________________

Address of financial institution _________________________________________________________

_________________________________________________________

_________________________________________________________

Complete the table below for the current year. Additional information regarding first-time home buyer

savings account is provided on the back of this form. If you made withdrawals from your first-time home

buyer savings account that were not used to pay qualifying expenses, please call the department for

information at (406) 444-6900.

A

B

C

D

Date

Deposits

Interest

Withdrawals

Withdrawals

Balance

earned

used for

used for

columns A + B

eligible

noneligible

less columns

expenses

expenses

C + D

Enter beginning balance as of January 1.

Carry over amount from ending balance of prior year.

Dec. 31

Carry forward balance as of December 31 to next year’s FTB account.

Your allowable reduction is the total of column A or $3,000, whichever is less, plus the interest earned on the principal

balance.

When you file your Montana income tax return electronically you represent that you have retained all documents

required as a tax record and that you will provide a copy to the department upon request.

158

1

1