Employer'S Withholding Tax Forms And Instructions - Grand Rapids City Income Tax - 2012

ADVERTISEMENT

BULK RATE

RETURN TO:

U.S. POSTAGE

GRAND RAPIDS CITY INCOME TAX

PAID

P.O. BOX 347

GRAND RAPIDS, MI 49501-0347

GRAND RAPIDS, MI

PERMIT NO. 236

ADDRESS SERVICE REQUESTED

MAIL TO:

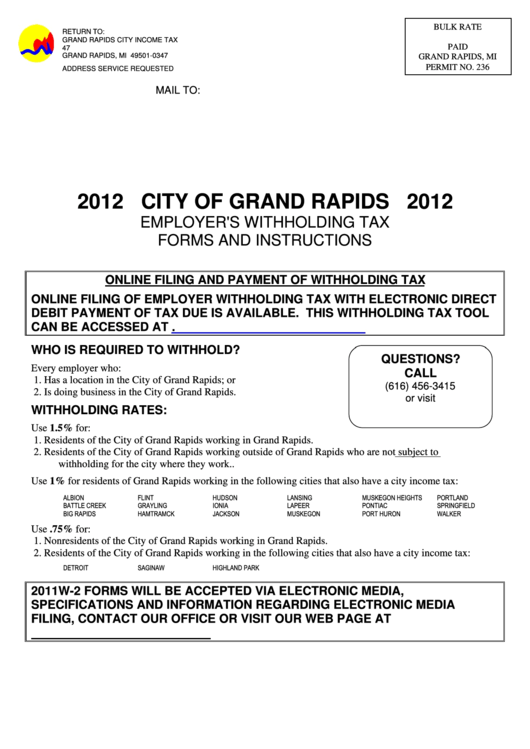

2012 CITY OF GRAND RAPIDS 2012

EMPLOYER'S WITHHOLDING TAX

FORMS AND INSTRUCTIONS

ONLINE FILING AND PAYMENT OF WITHHOLDING TAX

ONLINE FILING OF EMPLOYER WITHHOLDING TAX WITH ELECTRONIC DIRECT

DEBIT PAYMENT OF TAX DUE IS AVAILABLE. THIS WITHHOLDING TAX TOOL

CAN BE ACCESSED AT

WHO IS REQUIRED TO WITHHOLD?

QUESTIONS?

Every employer who:

CALL

1. Has a location in the City of Grand Rapids; or

(616) 456-3415

2. Is doing business in the City of Grand Rapids.

or visit

WITHHOLDING RATES:

Use 1.5% for:

1. Residents of the City of Grand Rapids working in Grand Rapids.

2. Residents of the City of Grand Rapids working outside of Grand Rapids who are not subject to

withholding for the city where they work..

Use 1% for residents of Grand Rapids working in the following cities that also have a city income tax:

ALBION

FLINT

HUDSON

LANSING

MUSKEGON HEIGHTS

PORTLAND

BATTLE CREEK

GRAYLING

IONIA

LAPEER

PONTIAC

SPRINGFIELD

BIG RAPIDS

HAMTRAMCK

JACKSON

MUSKEGON

PORT HURON

WALKER

Use .75% for:

1. Nonresidents of the City of Grand Rapids working in Grand Rapids.

2. Residents of the City of Grand Rapids working in the following cities that also have a city income tax:

DETROIT

SAGINAW

HIGHLAND PARK

2011 W-2 FORMS WILL BE ACCEPTED VIA ELECTRONIC MEDIA, CD-ROM. FOR

SPECIFICATIONS AND INFORMATION REGARDING ELECTRONIC MEDIA

FILING,

CONTACT

OUR

OFFICE

OR

VISIT

OUR

WEB

PAGE

AT

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3