Instructions For Form Dr-144es - The Declaration Of Estimated Gas And Sulfur Production Tax

ADVERTISEMENT

DR-144ES

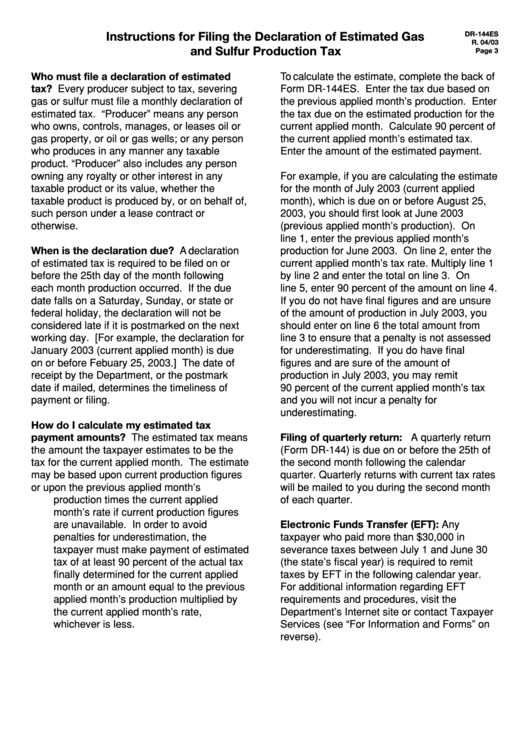

Instructions for Filing the Declaration of Estimated Gas

R. 04/03

and Sulfur Production Tax

Page 3

To calculate the estimate, complete the back of

Who must file a declaration of estimated

tax? Every producer subject to tax, severing

Form DR-144ES. Enter the tax due based on

gas or sulfur must file a monthly declaration of

the previous applied month’s production. Enter

estimated tax. “Producer” means any person

the tax due on the estimated production for the

who owns, controls, manages, or leases oil or

current applied month. Calculate 90 percent of

gas property, or oil or gas wells; or any person

the current applied month’s estimated tax.

who produces in any manner any taxable

Enter the amount of the estimated payment.

product. “Producer” also includes any person

owning any royalty or other interest in any

For example, if you are calculating the estimate

taxable product or its value, whether the

for the month of July 2003 (current applied

taxable product is produced by, or on behalf of,

month), which is due on or before August 25,

such person under a lease contract or

2003, you should first look at June 2003

otherwise.

(previous applied month’s production). On

line 1, enter the previous applied month’s

When is the declaration due? A declaration

production for June 2003. On line 2, enter the

of estimated tax is required to be filed on or

current applied month’s tax rate. Multiply line 1

before the 25th day of the month following

by line 2 and enter the total on line 3. On

each month production occurred. If the due

line 5, enter 90 percent of the amount on line 4.

date falls on a Saturday, Sunday, or state or

If you do not have final figures and are unsure

federal holiday, the declaration will not be

of the amount of production in July 2003, you

considered late if it is postmarked on the next

should enter on line 6 the total amount from

working day. [For example, the declaration for

line 3 to ensure that a penalty is not assessed

January 2003 (current applied month) is due

for underestimating. If you do have final

on or before Febuary 25, 2003.] The date of

figures and are sure of the amount of

receipt by the Department, or the postmark

production in July 2003, you may remit

date if mailed, determines the timeliness of

90 percent of the current applied month’s tax

payment or filing.

and you will not incur a penalty for

underestimating.

How do I calculate my estimated tax

payment amounts? The estimated tax means

Filing of quarterly return: A quarterly return

the amount the taxpayer estimates to be the

(Form DR-144) is due on or before the 25th of

tax for the current applied month. The estimate

the second month following the calendar

may be based upon current production figures

quarter. Quarterly returns with current tax rates

or upon the previous applied month’s

will be mailed to you during the second month

production times the current applied

of each quarter.

month’s rate if current production figures

are unavailable. In order to avoid

Electronic Funds Transfer (EFT): Any

penalties for underestimation, the

taxpayer who paid more than $30,000 in

taxpayer must make payment of estimated

severance taxes between July 1 and June 30

tax of at least 90 percent of the actual tax

(the state’s fiscal year) is required to remit

finally determined for the current applied

taxes by EFT in the following calendar year.

month or an amount equal to the previous

For additional information regarding EFT

applied month’s production multiplied by

requirements and procedures, visit the

the current applied month’s rate,

Department’s Internet site or contact Taxpayer

whichever is less.

Services (see “For Information and Forms” on

reverse).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2