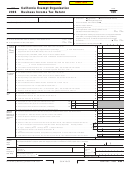

Form 109 - California Exempt Organization Business Income Tax Return - 2000 Page 5

ADVERTISEMENT

Add-On taxes or Recapture of Tax. See instructions.

Schedule K

1

Interest computation under the look-back method for completed long-term contracts. Attach form FTB 3834 . . . . . . . . . . . .

1

¼

2

Interest on tax attributable to installment: a Sales or certain timeshares or residential lots . . . . . . . . . . . . . . . . . . . . . . . .

2a

¼

b Method for non-dealer installment obligations . . . . . . . . . . . . . . . . . . . . . . . .

2b

¼

3

IRC Section 197(f)(9)(B)(ii) election to recognize gain on the disposition of intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

¼

4

Credit recapture. Credit name___________________________________________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

¼

5

Total. Combine the amounts on line 1 through line 4. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

¼

Apportionment Formula Worksheet

Schedule R

Use only for unrelated trade or business amounts

(a) Total within and

(b) Total within California

(c) Percent within

outside California

California (b) ÷ (a)

1

Property factor: See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

Payroll factor: Wages and other compensation of employees . . . . . . . . . . . . . . . . . .

3

Sales factor: Gross sales and/or receipts less returns and allowances . . . . . . . . . . . .

4

Multiply the factor on line 3, column (c) by 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Total percentage: Add the percentages in column (c) line 1, line 2, and line 4 . . . . . . .

6

Average apportionment percentage: Divide the factor on line 5 by 4 and enter the

result here and on Form 109, Side 1, line 2a. See instructions for exceptions . . . . . . .

1 0 9 0 0 5 0 9

Form 109

2000

Side 5

C1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5