Daily Rental Property Tax Quarterly Reporting Statement - County Of Prince William - 2016

ADVERTISEMENT

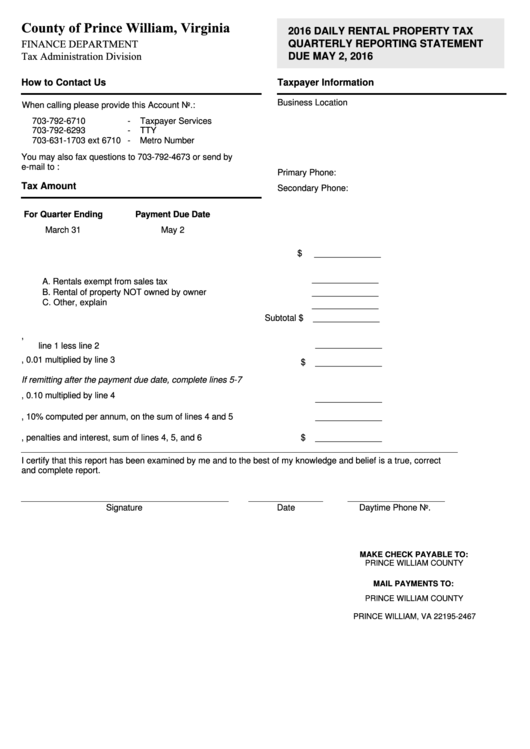

County of Prince William, Virginia

2016 DAILY RENTAL PROPERTY TAX

FINANCE DEPARTMENT

QUARTERLY REPORTING STATEMENT

Tax Administration Division

DUE MAY 2, 2016

How to Contact Us

Taxpayer Information

Business Location

When calling please provide this Account No.:

703-792-6710

-

Taxpayer Services

703-792-6293

-

TTY

703-631-1703 ext 6710

-

Metro Number

You may also fax questions to 703-792-4673 or send by

e-mail to :

Primary Phone:

Tax Amount

Secondary Phone:

For Quarter Ending

Payment Due Date

March 31

May 2

1.

Gross rental proceeds of ALL rental property

$

______________

2.

Exempt rental proceeds

______________

A. Rentals exempt from sales tax

B. Rental of property NOT owned by owner

______________

C. Other, explain

______________

Subtotal $

______________

3.

Rental proceeds subject to the daily rental property tax,

______________

line 1 less line 2

4.

TAX DUE, 0.01 multiplied by line 3

$

______________

If remitting after the payment due date, complete lines 5-7

5.

Penalty for late payment, 0.10 multiplied by line 4

______________

6.

Interest, 10% computed per annum, on the sum of lines 4 and 5

______________

7.

Total tax, penalties and interest, sum of lines 4, 5, and 6

$

______________

I certify that this report has been examined by me and to the best of my knowledge and belief is a true, correct

and complete report.

Signature

Date

Daytime Phone No.

MAKE CHECK PAYABLE TO:

PRINCE WILLIAM COUNTY

MAIL PAYMENTS TO:

PRINCE WILLIAM COUNTY

P.O. BOX 2467

PRINCE WILLIAM, VA 22195-2467

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1