Form Gr-1120es-Eft - Corporation Estimated Income Tax Payment Voucher - 2013

ADVERTISEMENT

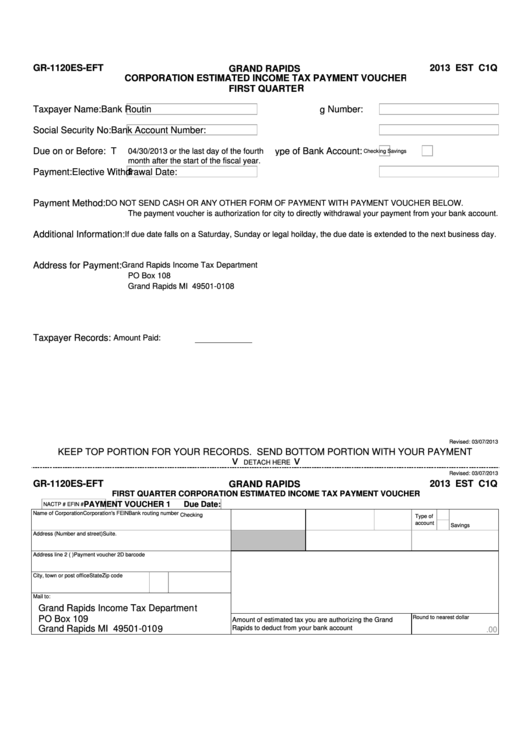

GR-1120ES-EFT

2013 EST C1Q

GRAND RAPIDS

CORPORATION ESTIMATED INCOME TAX PAYMENT VOUCHER

FIRST QUARTER

Taxpayer Name:

Bank Routing Number:

Social Security No:

Bank Account Number:

Due on or Before:

Type of Bank Account:

04/30/2013 or the last day of the fourth

Checking

Savings

month after the start of the fiscal year.

Payment:

Elective Withdrawal Date:

$

Payment Method:

DO NOT SEND CASH OR ANY OTHER FORM OF PAYMENT WITH PAYMENT VOUCHER BELOW.

The payment voucher is authorization for city to directly withdrawal your payment from your bank account.

Additional Information:

If due date falls on a Saturday, Sunday or legal hoilday, the due date is extended to the next business day.

Address for Payment:

Grand Rapids Income Tax Department

PO Box 108

Grand Rapids MI 49501-0108

Taxpayer Records:

Amount Paid:

Revised: 03/07/2013

KEEP TOP PORTION FOR YOUR RECORDS. SEND BOTTOM PORTION WITH YOUR PAYMENT

v

v

DETACH HERE

Revised: 03/07/2013

GR-1120ES-EFT

2013 EST C1Q

GRAND RAPIDS

FIRST QUARTER CORPORATION ESTIMATED INCOME TAX PAYMENT VOUCHER

PAYMENT VOUCHER 1

Due Date:

NACTP #

EFIN #

Name of Corporation

Corporation's FEIN

Bank routing number

Checking

Type of

account

Savings

Address (Number and street)

Suite. no.

Bank account number

Elective withdrawal date

Address line 2 (P.O. Box address for mailing use only)

Payment voucher 2D barcode

City, town or post office

State

Zip code

Mail to:

Grand Rapids Income Tax Department

PO Box 109

Round to nearest dollar

Amount of estimated tax you are authorizing the Grand

Grand Rapids MI 49501-0109

Rapids to deduct from your bank account

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4