Form St-A-102 - Affidavit Of Exemption - Maine Revenue Services

ADVERTISEMENT

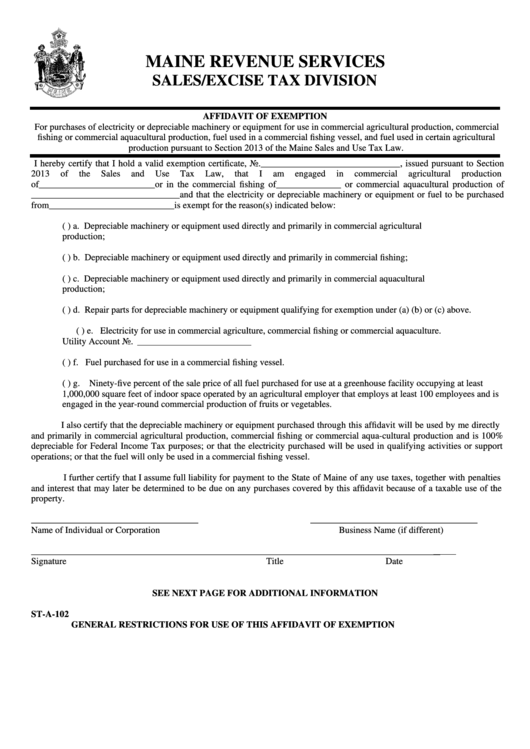

MAINE REVENUE SERVICES

SALES/EXCISE TAX DIVISION

AFFIDAVIT OF EXEMPTION

For purchases of electricity or depreciable machinery or equipment for use in commercial agricultural production, commercial

fishing or commercial aquacultural production, fuel used in a commercial fishing vessel, and fuel used in certain agricultural

production pursuant to Section 2013 of the Maine Sales and Use Tax Law.

I hereby certify that I hold a valid exemption certificate, No.______________________________, issued pursuant to Section

2013

of

the

Sales

and

Use

Tax

Law,

that

I

am

engaged

in

commercial

agricultural

production

of_________________________or in the commercial fishing of______________ or commercial aquacultural production of

________________________________and that the electricity or depreciable machinery or equipment or fuel to be purchased

from___________________________is exempt for the reason(s) indicated below:

( ) a. Depreciable machinery or equipment used directly and primarily in commercial agricultural

production;

( ) b. Depreciable machinery or equipment used directly and primarily in commercial fishing;

( ) c. Depreciable machinery or equipment used directly and primarily in commercial aquacultural

production;

( ) d. Repair parts for depreciable machinery or equipment qualifying for exemption under (a) (b) or (c) above.

( ) e. Electricity for use in commercial agriculture, commercial fishing or commercial aquaculture.

Utility Account No.

( ) f. Fuel purchased for use in a commercial fishing vessel.

( ) g. Ninety-five percent of the sale price of all fuel purchased for use at a greenhouse facility occupying at least

1,000,000 square feet of indoor space operated by an agricultural employer that employs at least 100 employees and is

engaged in the year-round commercial production of fruits or vegetables.

I also certify that the depreciable machinery or equipment purchased through this affidavit will be used by me directly

and primarily in commercial agricultural production, commercial fishing or commercial aqua-cultural production and is 100%

depreciable for Federal Income Tax purposes; or that the electricity purchased will be used in qualifying activities or support

operations; or that the fuel will only be used in a commercial fishing vessel.

I further certify that I assume full liability for payment to the State of Maine of any use taxes, together with penalties

and interest that may later be determined to be due on any purchases covered by this affidavit because of a taxable use of the

property.

____________________________________

____________________________________

Name of Individual or Corporation

Business Name (if different)

________________________________________________________________________________________

Signature

Title

Date

SEE NEXT PAGE FOR ADDITIONAL INFORMATION

ST-A-102

GENERAL RESTRICTIONS FOR USE OF THIS AFFIDAVIT OF EXEMPTION

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2