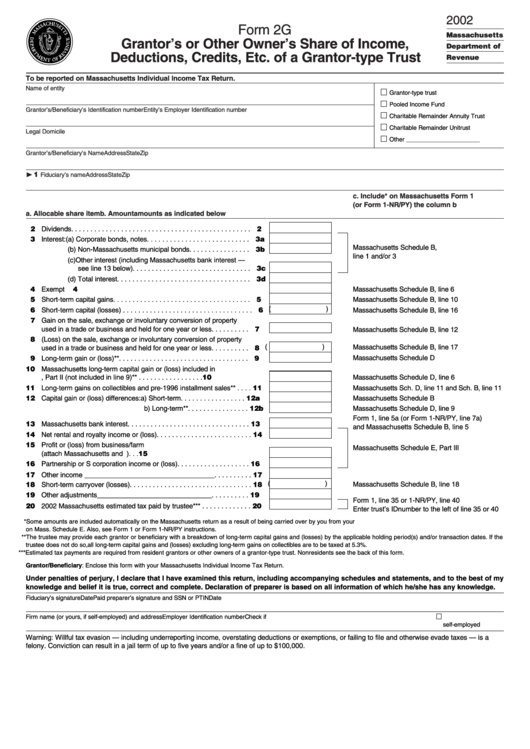

Form 2g - Grantor'S Or Other Owner'S Share Of Income, Deductions, Credits, Etc. Of A Grantor-Type Trust - 2002

ADVERTISEMENT

2002

Form 2G

Massachusetts

Grantor’s or Other Owner’s Share of Income,

Department of

Deductions, Credits, Etc. of a Grantor-type Trust

Revenue

To be reported on Massachusetts Individual Income Tax Return.

Name of entity

Grantor-type trust

Pooled Income Fund

Grantor’s/Beneficiary’s Identification number

Entity’s Employer Identification number

Charitable Remainder Annuity Trust

Charitable Remainder Unitrust

Legal Domicile

Other ______________________

Grantor’s/Beneficiary’s Name

Address

State

Zip

❿ 1

Fiduciary’s name

Address

State

Zip

c. Include* on Massachusetts Form 1

(or Form 1-NR/PY) the column b

a. Allocable share item

b. Amount

amounts as indicated below

12 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Interest: (a) Corporate bonds, notes. . . . . . . . . . . . . . . . . . . . . . . . . . . 13a

Massachusetts Schedule B,

(b) Non-Massachusetts municipal bonds . . . . . . . . . . . . . . . . 13b

line 1 and/or 3

(c) Other interest (including Massachusetts bank interest —

see line 13 below) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13c

(d) Total interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13d

14 Exempt U.S. interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Massachusetts Schedule B, line 6

Massachusetts Schedule B, line 10

15 Short-term capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Short-term capital (losses) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 (

)

Massachusetts Schedule B, line 16

17 Gain on the sale, exchange or involuntary conversion of property

used in a trade or business and held for one year or less . . . . . . . . . . 17

Massachusetts Schedule B, line 12

18 (Loss) on the sale, exchange or involuntary conversion of property

used in a trade or business and held for one year or less . . . . . . . . . . 18 (

)

Massachusetts Schedule B, line 17

Massachusetts Schedule D

19 Long-term gain or (loss)** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

10 Massachusetts long-term capital gain or (loss) included in

U.S. Form 4797, Part II (not included in line 9)** . . . . . . . . . . . . . . . . . 10

Massachusetts Schedule D, line 6

11 Long-term gains on collectibles and pre-1996 installment sales** . . . . 11

Massachusetts Sch. D, line 11 and Sch. B, line 11

12 Capital gain or (loss) differences: a) Short-term . . . . . . . . . . . . . . . . . 12a

Massachusetts Schedule B

b) Long-term** . . . . . . . . . . . . . . . . 12b

Massachusetts Schedule D, line 9

Form 1, line 5a (or Form 1-NR/PY, line 7a)

13 Massachusetts bank interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

and Massachusetts Schedule B, line 5

14 Net rental and royalty income or (loss). . . . . . . . . . . . . . . . . . . . . . . . . 14

15 Profit or (loss) from business/farm

Massachusetts Schedule E, Part III

(attach Massachusetts and U.S. Schedule C or U.S. Schedule F) . . . 15

16 Partnership or S corporation income or (loss) . . . . . . . . . . . . . . . . . . . 16

17 Other income __________________________________ . . . . . . . . . . 17

18 Short-term carryover (losses). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 (

)

Massachusetts Schedule B, line 18

19 Other adjustments ______________________________ . . . . . . . . . . 19

Form 1, line 35 or 1-NR/PY, line 40

20 2002 Massachusetts estimated tax paid by trustee*** . . . . . . . . . . . . . 20

Enter trust’s ID number to the left of line 35 or 40

*Some amounts are included automatically on the Massachusetts return as a result of being carried over by you from your U.S. Form 1040. Do not report any dividends or interest

on Mass. Schedule E. Also, see Form 1 or Form 1-NR/PY instructions.

**The trustee may provide each grantor or beneficiary with a breakdown of long-term capital gains and (losses) by the applicable holding period(s) and/or transaction dates. If the

trustee does not do so, all long-term capital gains and (losses) excluding long-term gains on collectibles are to be taxed at 5.3%.

***Estimated tax payments are required from resident grantors or other owners of a grantor-type trust. Nonresidents see the back of this form.

Grantor/Beneficiary: Enclose this form with your Massachusetts Individual Income Tax Return.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief it is true, correct and complete. Declaration of preparer is based on all information of which he/she has any knowledge.

Fiduciary’s signature

Date

Paid preparer’s signature and SSN or PTIN

Date

Firm name (or yours, if self-employed) and address

Employer Identification number

Check if

self-employed

Warning: Willful tax evasion — including underreporting income, overstating deductions or exemptions, or failing to file and otherwise evade taxes — is a

felony. Conviction can result in a jail term of up to five years and/or a fine of up to $100,000.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1